Smart Money is a weekly overview of everything finance. We provide the best actionable information and insights on Forex, Stocks, and Crypto Currencies. Smart Money is intended for Investment Awareness and Education and should not be considered Financial Advice.

Welcome to the first edition of Smart Money. In the investment world, Smart Money is money that is invested by people who know a lot about investing. In this edition, we will go through

- Status of Forex Market

- Dollar Currency Index

- Status of Stock Market

- S&P 500

- Status of Crypto Market

- Bitcoin, Ethereum, and Opportunities

Overview of Macro-Finance

Table of Contents

Despite high interest rates, the US economy remains strong. This contrasts the popular belief that the economy endures a slowdown under high-interest rates. The conflicts in Israel and Palestine force the oil prices to rise and may force the Federal Reserve to maintain its hawkish stance. However, China is countering economic sluggishness with targeted, incremental stimulus, focusing on high-quality growth. UK’s challenges remain in its mortgage market and refinancing at higher rates. All of this suggests that the soft landing is an improbable scenario.

Inflationary pressure is easing, and US core CPI inflation fell below expectations in October 2023. Federal Reserve and European Central Bank have reached the end of their tightening cycles, and we can expect a neutral to bullish response from the stock and crypto markets. We expect further rate cuts in 2024 that will aid with bullish momentum.

One of the key assets that will directly benefit from the disinflation is Mortgage-backed securities. 2023 has been difficult for the sector, given the downfall in demand and higher interest rate volatility. The disinflation will stabilize the monetary policy, do away with rate volatility, and organically increase demand.

Status of Forex Market

DXY

DXY (Dollar Currency Index) has made a lower high and lower low in the fourth week of November. This indicates the ongoing bullish momentum is stronger in the low time frame. It applies to the stock and crypto markets, with volatility shifting to riskier assets the following week.

Euro

The Euro is showing strength against the USD, with a respectable 1.29% gain over the week. The trend is likely to continue with a target of 1.10 by the first week of December. However, the machine learning algorithm predicts a downward move to 0.97 by mid-December, with liquidity gaps at 1.0787 and 1.04895.

Interest Rates

The interest rates, however, have been remarkably stable since June 2023. Such stability was observed during 2020-2022, the best bullish years since the dot com bubble. The rate crossed the highs of 2007 (5.25), suggesting an impending collapse of the stock market similar to 2008.

Status of the Stock Market

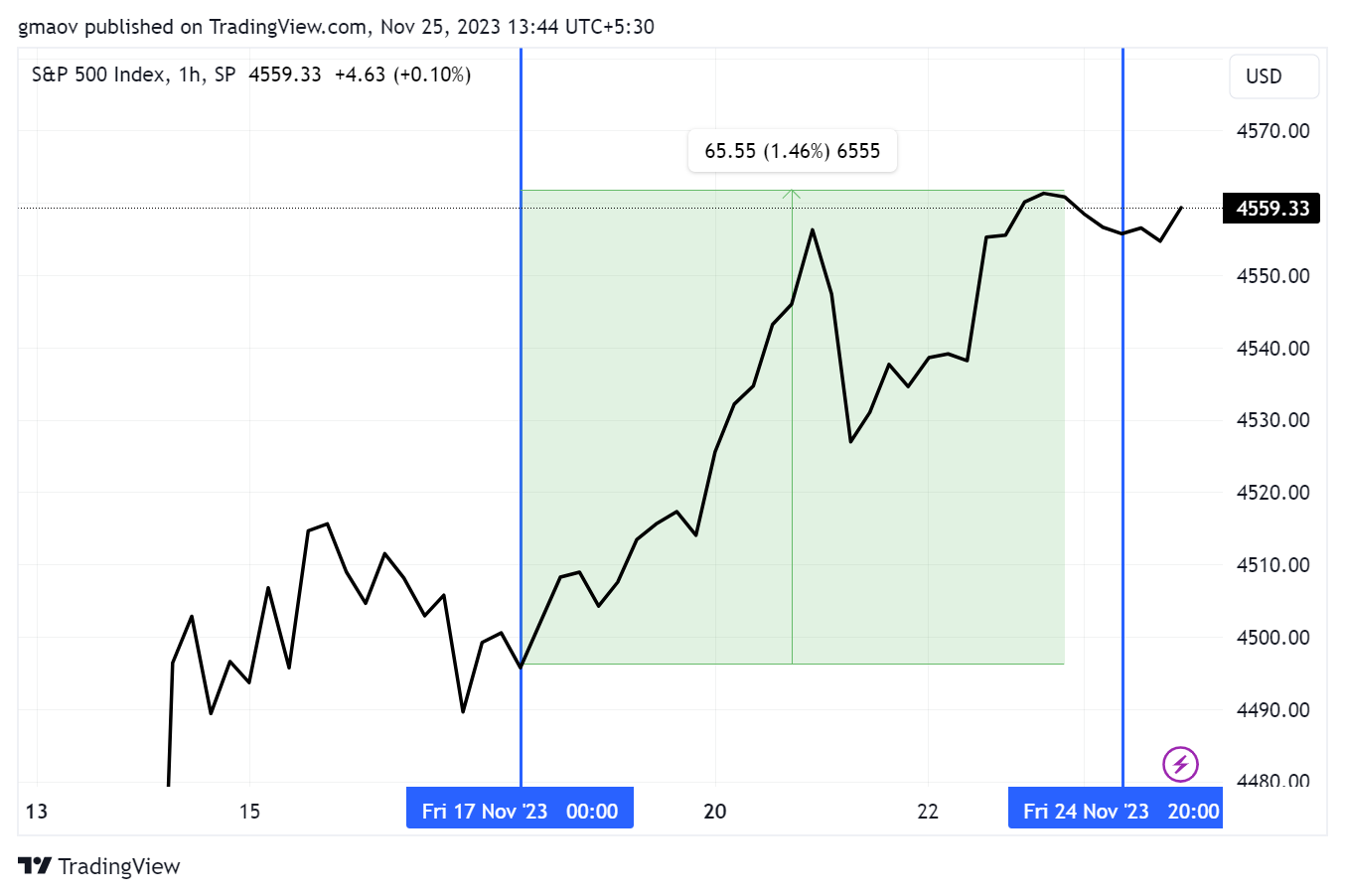

The financial markets experienced a notable upswing, with major Wall Street indexes registering weekly gains and global equities approaching their most substantial one-month rally since November 2020. S&P 500 has gained 55.55 points and 1.46% in the fourth week of November. This occurred during a shortened trading session after the U.S. Thanksgiving holiday. In the commodities sector, oil futures remained steady in anticipation of the upcoming OPEC+ meeting, which might result in output cuts for 2024. Concurrently, gold futures saw an uptick.

The MSCI’s global shares index recorded a significant monthly gain, fueled by growing investor confidence. Stock indices like the STOXX 600 and Germany’s DAX closed higher in Europe. The geopolitical landscape also played a role as a ceasefire between Israel and Hamas commenced.

Best Stocks

However, the center of attraction was three companies: OpenAI, Microsoft, and BioNexus.

Greg Brockman and Sam Altman, the founders of OpenAI, were removed by the OpenAI Board. It created waves in the big tech industry, and Microsoft CEO Satya Nadella responded quickly.

Following the tweet, MSFT continued its uptrend and registered a 3.5% gain over the week. The uptrend is promising, given the increasing R&D on AI.

Soon enough, OpenAI was forced to reverse the decision and reappointed Sam Altman as CEO with a new board in place. OpenAI is not public yet, is valued at $80B, and is the third most valuable startup behind SpaceX.

However, the biggest gainer of the week was BioNexus Gene Lab Corp. It is a holding company, which sells chemical raw materials for the manufacture of industrial, medical, appliance, aero, automotive, mechanical, and electronic industries. It is also involved in developing liquid biopsy tests for the early detection of biomarkers linked to diseases. The company was founded in 2017 and is headquartered in Kuala Lumpur, Malaysia. The stock BGSL, listed in NASDAQ, gained over 187% over the week.

As China reports a new respiratory illness, chemical manufacturers and Pharmaceuticals will be the biggest gainers in the next few weeks. WHO says the new disease may be a variant of pneumonia bacteria.

Therefore, the companies that are set to gain from the situation are

- Novartis – Found in 1996 and based in Switzerland

- Moderna Therapeutics – Found in 2010 and based in the USA

- Pfizer – Found in 1848 and based in the USA

Crypto Currencies

Bitcoin

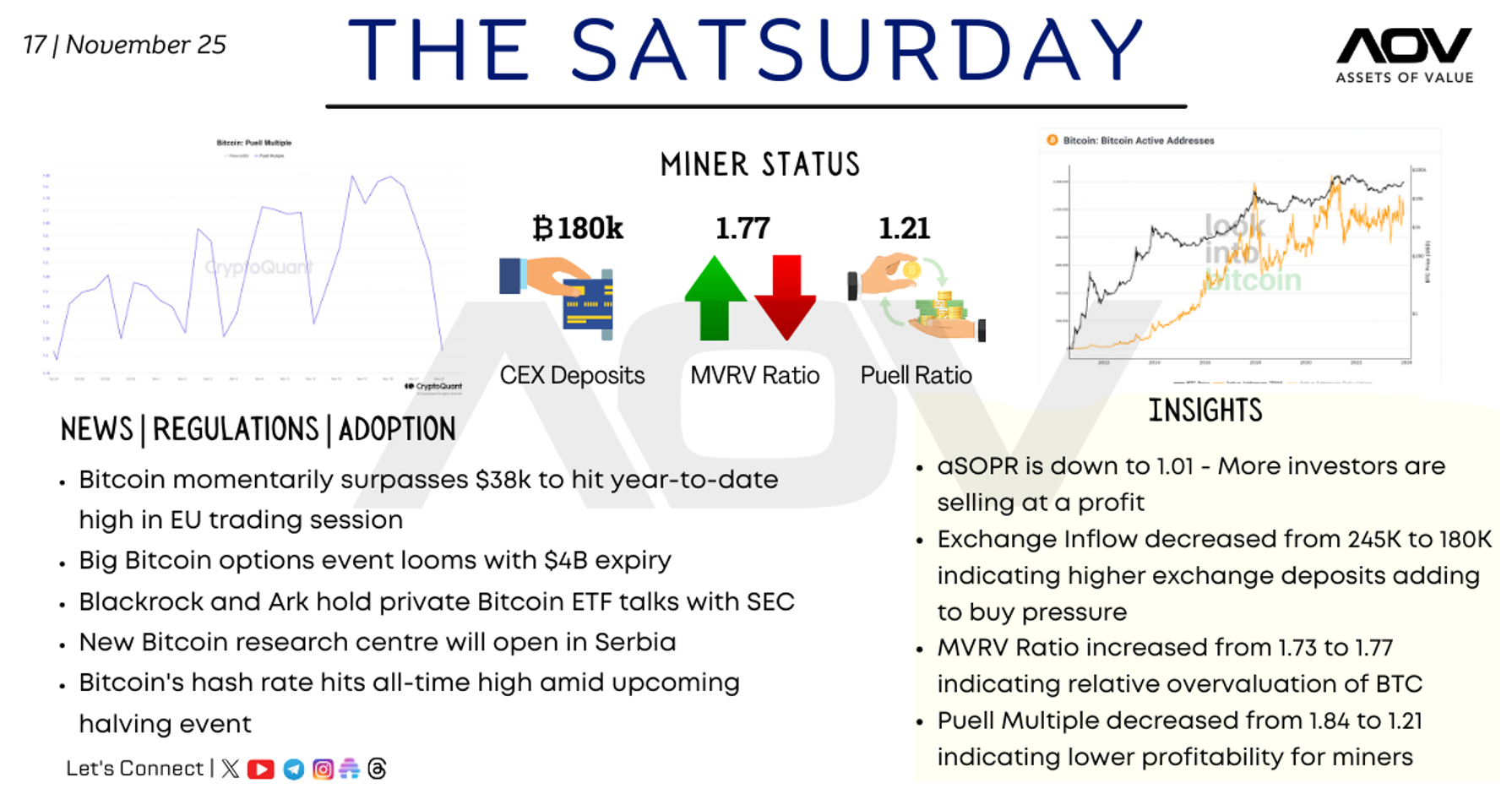

Bitcoin is continuing its bullish momentum, registering an impressive 7.71% gain over the week. Bitcoin’s 70% supply has remained dormant for at least a year, marking a new record. There is likely fresh capital injection after the ETF approval.

However, the latest onchain data from miners suggest that bearishness is coming for Bitcoin. The Bitcoin Miner in-house transactions peaked on the 24th of November. This suggests that miners are transferring their BTC between wallets before depositing in exchanges to sell. In such a scenario, BTC will have to 37.3k and 38k to grab the liquidity at 35.2k and 34.4k.

Ethereum

ETH has been underperforming Bitcoin for a while now. The increase in gas fees, and volume of Layer-2s are questioning its scalability and actual use cases. However, the fundamentals remain strong, generating around $58m in revenue in the last week alone. Arbitrum and Polygon lead in stats like TVL, unique wallets, and fees.

In a rather surprising event, the CEO of Binance, CZ, has stepped down. Although it could have caused major FUD in the market, Bitcoin responded rather neutrally. Binance has a new leadership now and is required to pay a fine of $4B as DOJ settlement.

Unsurprisingly, BNB has dropped 17% after the tweet.

A drop to 222 and 204 is likely in the coming days. Users can take caution and withdraw funds from Binance to be on the safer side.

On 21st November, the Phantom wallet on Solana launched a cross-chain swapper to bridge liquidity from the Ethereum ecosystem. This is bullish for SOL, and we can expect a bounce back in SOL to $63 and more next week.

That’s all for this week’s Smart Money. See you again next week!

Here is a solid short-term price action from Illuvium. Breakout of $108.63 can push the price to $275 and $314. Illuvium has interesting updates coming in December; fingers crossed, ciao!

Found value in the insights shared here? Check out our YouTube and Twitter, loaded with content meant to educate and entertain.

Follow our Telegram for a sneak peek at alpha; for an even deeper dive, join our Patreon community, where we share exclusive alpha for you to be the ‘early bird.’

Follow us today, and let’s explore Web3 together!