Smart Money is a weekly overview of everything finance. We provide the best actionable information and insights on Forex, Stocks, and Crypto Currencies. Smart Money is intended for Investment Awareness and Education and should not be considered Financial Advice.

Welcome to Smart Money’s second edition! In the investment realm, Smart Money refers to the capital under the control of institutional investors, central banks, and other financial titans. Simply put, it’s the money wielded by the experts in the financial world.

“Smart investing is like good nutrition. Unfortunately, too many investors start with dessert.”

In this edition, we will go through

- Status of Forex Market

- Dollar Currency Index

- Status of Stock Market

- Status of Crypto Market

- Bitcoin, Ethereum, and Opportunities

Overview of Macro-Finance

Table of Contents

Europe is stealing the spotlight from the US, managing low unemployment at 6%. While the US grapples with rising debts exceeding 100% of its economy, Europe’s more conservative 83% debt ratio tells a different story.

Europe

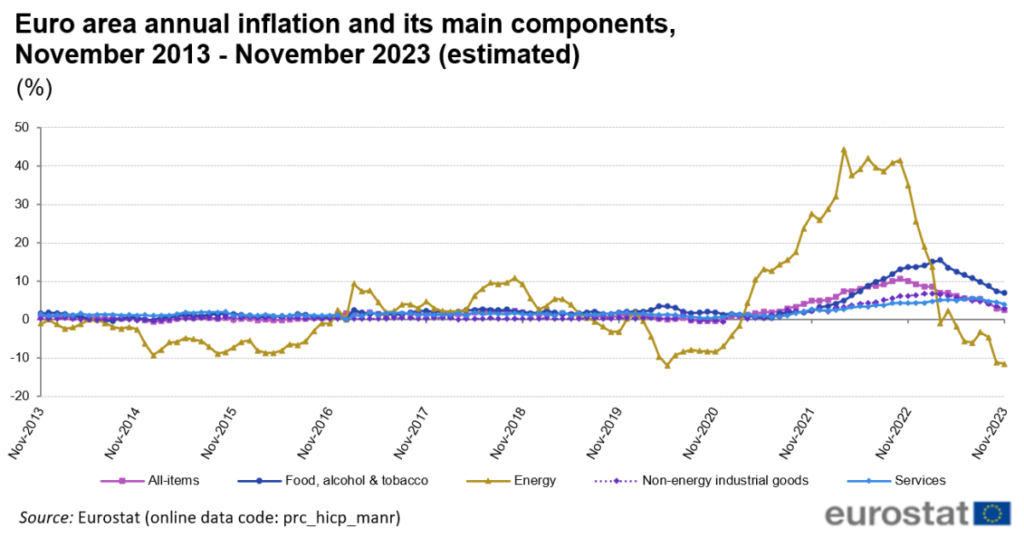

November saw a 2.4% price increase compared to the previous year, nearly hitting the European Central Bank’s target. Core inflation, excluding volatile food and energy prices, surprised at 3.6%

Source: EuroStat

But the ECB can’t chill yet—high interest rates tamed inflation and might hit the economy. Investors brace for potential interest rate cuts.

Winter’s here, but Europe’s not shivering. It slashed reliance on Russian gas from 40% to 12%, reducing vulnerability to supply issues and inflation sparks. Gas storage is ample, providing a cushion against unexpected supply disruptions.

China

Meanwhile, China’s economic engine is idling, with manufacturing and services sectors showing lower-than-expected numbers.

- Once a global envy, it now faces a slowdown.

- The government may need bold measures to prevent embarrassment on the global stage.

China’s economic challenges are hushed up, with major banks discouraging negative outlooks. Surprisingly, the US stock market remains resilient, partly due to diversified indexes and anticipation of China’s impact already factored into share prices.

US

Shifting gears to the US, the economy sprinted at a 5.2% annualized rate in Q3, surpassing expectations. However, the glow may be fading. Higher borrowing costs are crimping hiring and spending.

While GDP paints a rosy picture, peeking into gross domestic income (GDI) reveals a different tale.

- GDI growth lags behind GDP by the most since 2007, hinting at underlying economic challenges.

- This gap could explain why Americans feel uneasy about the economy and the slowing labor market.

Some predict a consumer-led slowdown, possibly nudging the US economy toward recession by the first quarter of next year.

Nevertheless, Bonds are on a historic run, marking their best month since 1985, driven by a post-October peak in yields.

- Investors are betting on imminent Federal Reserve interest rate cuts in the first half of next year, fueled by signs of a slowing US economy and easing inflation.

The yield curve, indicating a recession risk, is adjusting as investors’ prices at the end of the Fed’s tightening cycle are currently at minus 38.50 bps.

- Described as a “bull steepener,” this suggests expectations of Fed interest rate cuts.

- The rally’s future hinges on ongoing economic and inflation signals, along with confirmation that the Fed is done raising rates.

Europe shines, China pauses, and the US stock market stays immune—for now.

Status of Forex Market

DXY

The dollar index, gauging its strength against six major currencies, celebrated its best day in weeks, extending a recovery from monthly lows and surging past 103. While this is a corrective move, US fundamentals may prevent it from hitting fresh lows in the coming weeks.

- The dollar’s boost could be linked to month-end demand, as investors squared up positions for November. This month featured a sharp sell-off in the US currency, with the market anticipating rate cuts next year.

- Contrarily, some expected a dollar sell-off at month’s end, considering the robust gains equities made in November.

Euro

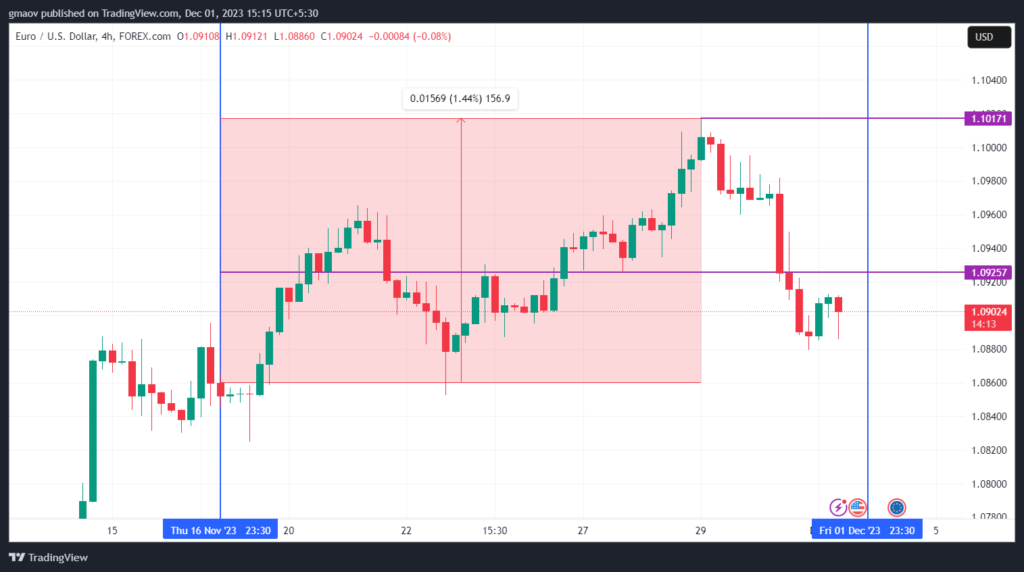

Our last forecast hit the bullseye! Euro/USD met the 1.10 target and dived.

The Euro’s struggle continued, showing a slowdown in Eurozone inflation.

- This drop was triggered by lower-than-expected inflation, fueling expectations of European Central Bank rate cuts.

- Investors eagerly await euro zone-wide inflation and the U.S. PCE index for the next move.

After slipping below 1.09, EUR/USD is making a comeback attempt. A successful recovery aims for the 1.092 price zone, eyeing the November high at 1.1017. Surpassing this level marks a higher high.

Interest Rates

As highlighted in the last edition, interest rates have maintained exceptional stability since June 2023. The metric echoes the steadiness observed in the bullish years of 2020-2022, reminiscent of the dot com bubble era.

Notably, the current rate has surpassed the 2007 highs at 5.25%, raising concerns about a potential stock market collapse akin to 2008.

Status of the Stock Market

The US stock market just wrapped up one of its best months in almost a year and a half, with November proving to be a standout period.

- MSCI’s global stock index is on track to finish the month up nearly 9%, marking its strongest performance since November 2020.

- This surge is reminiscent of the optimism during the initial stages of the COVID-19 vaccine rollout.

Besides, November turned into a fairytale for equities, with the anticipated Santa rally appearing early as traders bet on a Goldilocks scenario of falling inflation and central banks cutting interest rates.

The S&P 500 soared over 8% this month, and the Nasdaq wasn’t far behind, clocking a 10% increase – their most spectacular performance since July 2022. After a three-month losing streak, the Dow bounced back with an approximately 8.8% rise, achieving its best month since October 2022.

- Salesforce’s stock contributed to the Dow’s success, soaring 9.4% after an impressive earnings report.

- Yet, the tech-heavy Nasdaq felt the weight of losses from mega-cap giants Nvidia and Meta, down 2.9% and 1.5%, respectively.

Oil

Meanwhile, the oil market is experiencing turbulence as OPEC debates output quotas. OPEC’s recent voluntary production restrictions may have seemed underwhelming, but challenges in maintaining unity persist.

- Although prices dipped over 5% in November and suffered a 10% decline in October, they are unlikely to stay low for long.

As worries about global demand continue, Goldman Sachs warns that oil prices could surge to $100 a barrel next year, citing potential supply disruption risks.

- The impact of disruptions, such as US sanctions and conflicts in the Middle East, may be limited, but oil prices remain volatile.

Although the Israel-Hamas war had a muted impact this year, past events, like the Russia-Ukraine war in 2022, show oil prices can spike temporarily due to disruption fears.

S&P 500

After a staggering $3 trillion surge this month, the S&P 500 is within 5% of its all-time high. November witnessed a remarkable 8.9% climb, a feat achieved fewer than ten times in that month since 1928.

Breaking a three-month losing streak, this resurgence reflects investor optimism overlooking recession fears, geopolitical tensions, and rising borrowing costs.

- Expedia Group soared 42.9% in November, claiming the top spot in the S&P 500. It marks their best month since April 2009, and continues their winning streak with a 55% surge in 2023.

- Insulet secured second place with a 42.6% jump, its best month since December 2008. Solid financial results and increased revenue growth estimates fueled investor optimism.

- However, Paycom Software fell 26%, its worst month since March 2020, after cutting fiscal-year revenue guidance.

November typically kicks off the best six months for the S&P 500, driven by increased stock buying from companies and pension plans.

- However, investors eyeing further gains face concentration risks, especially with mega-cap tech shares leading the rally.

- Inflation figures on Dec. 12 and the Fed’s subsequent rate decision pose additional challenges, compounded by the historical tendency for tech stocks to slump at year-end.

As December begins, all eyes are on the Fed’s anticipated rate hold on Dec. 13, accompanied by projections for the upcoming year.

Crypto Currencies

Bitcoin

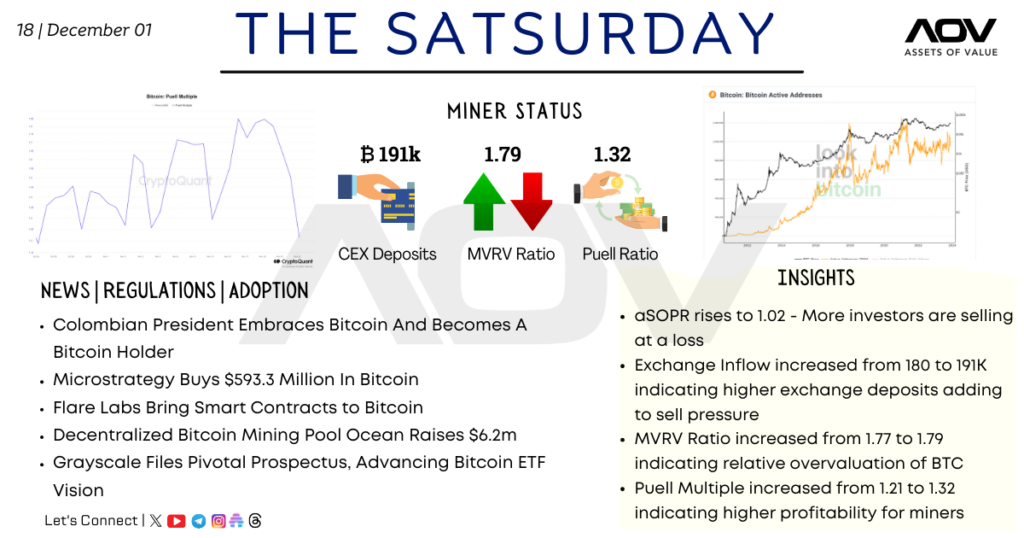

BTC wraps up November on a strong note, reaching $38,800, a level not seen since May 2022.

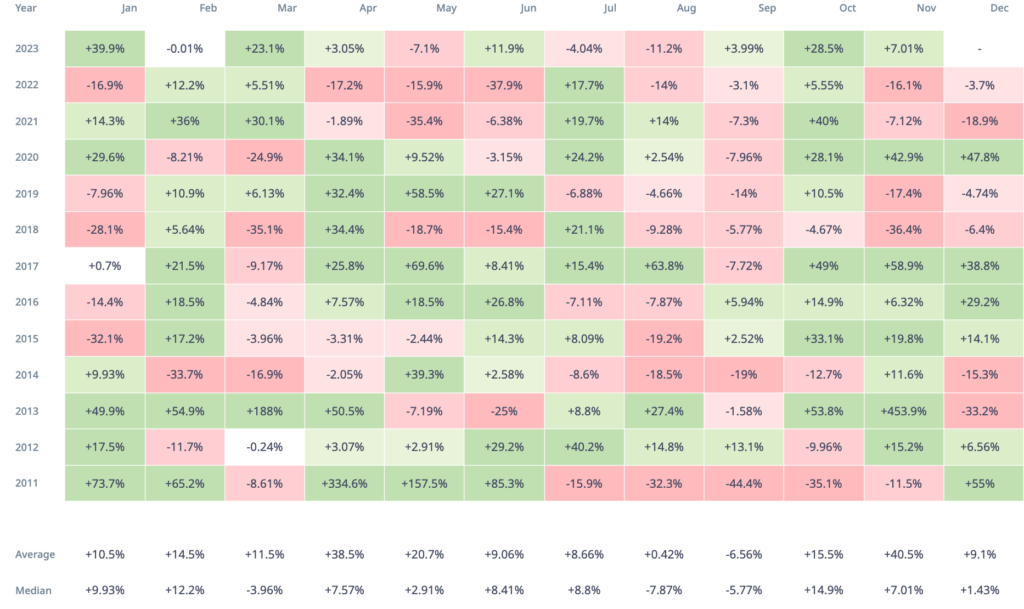

November’s monthly candle stands out, showcasing strength with a body low of around $34.5K, higher than the preceding candle’s body high—a bullish sign. Looking ahead, major resistance lies higher at $47,000 and around the 2021 all-time high of $69,000 on monthly timeframes.

Source: Glassnode

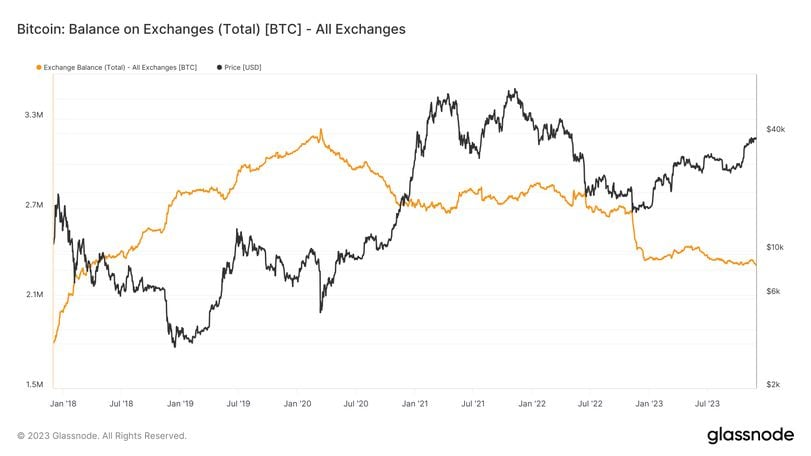

The case for Bitcoin rallying to $40,000 and beyond by year-end gains traction as over 37,000 BTC, valued at $1.4 billion, leaves centralized exchanges since Nov. 17.

- It signals investors opting for direct custody, reflecting a bias for long-term holding.

- The upbeat sentiment aligns with anticipation for a U.S. spot ETF launch, further reducing sell-side pressure.

Historically, exchange outflows precede local price lows, supporting expectations of a medium-term uptrend.

Source: CryptoRank

BTC gained momentum as Federal Reserve governor Chris Waller noted a slowdown in the economy and moderation in inflation, affirming current policies are in the “right spot.” Interest rate decisions typically sway markets, but December, historically neutral, adds an interesting twist to the mix.

Ethereum

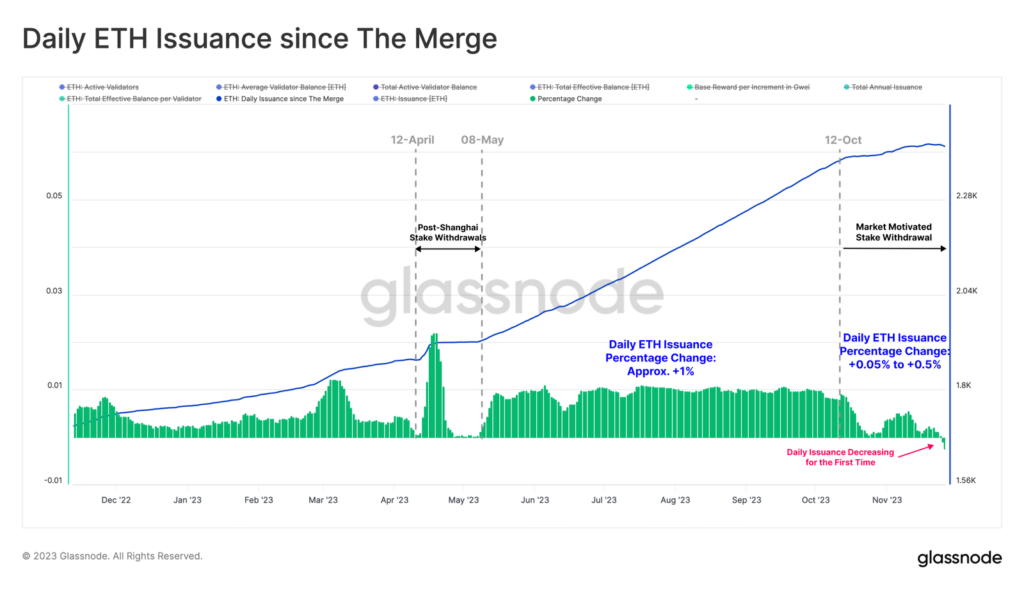

The Shanghai hard fork has been influencing Ethereum’s price dynamics, creating unease even before activation. With the upgrade in effect, the market is now witnessing concerns about unstaking.

Throughout this month, Ethereum’s price has circled the $2,000 mark. Currently, ETH is trading at $2,089, struggling to breach the $2,124 resistance for the second time in November. Despite breaking out of a recent downtrend, it remains at risk of dropping below the critical $2,000 support level.

The potential for a bullish shift is both plausible and uncertain.

- Ethereum’s deflationary status is a positive factor, indicating a reduction in its infinite supply, which tends to drive prices higher with increased demand.

- Additionally, the SEC acknowledging Fidelity Investments’ filing for a spot Ethereum ETF adds to the bullish case.

However, the deflationary conditions for Ethereum come with challenges.

Source: Glassnode

Glassnode reports a slowdown in daily ETH issuance growth, with a decrease of up to 0.5% per day over the last week. It complicates the bullish outlook.

In the altcoin front, Solana stands out, leading in price gains among major altcoins. Over the past seven days, SOL has experienced a 6% price growth, and the broader 30-day chart shows an impressive 59.21% gain.

Meanwhile, FTX secures court consent to sell assets from Grayscale and Bitwise Trusts, aiming to sell $691 million from five Grayscale trusts and $53 million from one Bitwise trust. This move, essential for potential sales and creditor repayment, could lead to significant price swings soon. Brace for impact!

That’s all for this week’s Smart Money. See you again next week!

Found value in the insights shared here? Check out our YouTube and Twitter, loaded with content meant to educate and entertain.

Follow our Telegram for a sneak peek at alpha; for an even deeper dive, join our Patreon community, where we share exclusive alpha for you to be the ‘early bird.’

Follow us today, and let’s explore Web3 together!