Now that we have covered the Binance Launchpool basics let’s look at the first 3 projects.

Project #1: Bella ($BEL)

Table of Contents

The first project featured on Launchpool was Bella Protocol. Through participation in Launchpool, users could stake their BNB, BUSD, or ARPA tokens in three distinct pools, earning BEL tokens over 30 days starting September 9, 2020. Binance subsequently listed BEL on September 16, 2020.

Bella Protocol offers a suite of DeFi products focused on auto-compounding yield and developer tools tailored for constructing DApps integrating Uniswap AMM. The flagship product, Bella Flex Savings, is a reliable smart mining solution providing users with low gas and management fees, automatic returns, token burning, and significant yield farming incentives. Flex Savings has been operational on Ethereum for over two years, boasting the highest Total Value Locked (TVL) exceeding $40 million.

Moreover, the core team at Bella successfully developed a developer tool called Tuner. This Uniswap V3 simulator allows for strategy backtesting on a transaction-to-transaction basis using arbitrary or historical data without the need for the Ethereum Virtual Machine (EVM). While operating independently, Tuner fully preserves the precise smart-contract behavior of Uniswap V3’s intricate design and implementation.

Simultaneously, the project introduced Bella LP Farm, a liquidity protocol strategically designed to optimize returns on liquidity provision on zkSync and Mantle. It employs a mutually beneficial mechanism that enhances liquidity for DEXs while providing liquidity providers with attractive staking incentives.

Furthermore, Bella Protocol has garnered support from prominent investors, including Binance Labs, Arrington XRP Capital, and several other renowned backers.

Tokenomics

The BEL token plays a pivotal role in the Bella Protocol ecosystem, serving both as a reward token and a voting token in the platform’s governance.

Users can use $BEL to receive staking incentives, obtain fee rewards within the farm network, and enjoy exclusive discounts on Bella Protocol items.

As per Cryptorank.io, 92.2% of the total BEL token supply is currently unlocked. The subsequent unlock, amounting to 0.78%, is scheduled for January 16, 2024, with an associated value of $557.31K (1.3% of Market Cap).

Source: CoinGecko

Besides, Bella Protocol successfully raised US$4.50 million through a private token sale conducted in August 2020, selling 6.00% of the overall token supply at US$0.75 per BEL. Currently, the token has a price of $0.70. For early investors in the private round, this results in a Return on Investment (ROI) of 0.95X on USD and 0.27X on BTC.

Notably, Binance listed the token at the same price as the private sale, leading to a maximum ROI of -6.67% for early investors who acquired the token through Binance.

Project Links

Project #2: Wing Finance ($WING)

Wing Finance was the second project featured on Binance Launchpool. Binance allowed users to stake their BNB, BUSD, or ONT tokens in three liquidity pools to farm WING tokens, commencing on September 15, 2020. Subsequently, Binance listed the WING token on September 16, 2020. Users who had previously deposited their BNB and BUSD to farm BEL tokens automatically participated in the WING farming initiative simultaneously.

Wing Finance is actively constructing a credit-based DeFi platform tailored for the digital asset lending market, facilitating cross-chain asset and protocol interactions. In addition to the prevalent over-collateralized lending services offered by DeFi projects, Wing aims to introduce a credit-based lending mechanism utilizing Distributed Identity (DID).

Supplemented by the Wing DAO, the platform employs a decentralized governance model and risk control mechanism to cultivate mutually beneficial relationships among borrowers, creditors, and guarantors.

Currently, Wing features four types of pools: Flash Pool, NFT Pool, Peer-to-Peer Pool, and Inclusive Pool. The platform has deployed its offerings on four networks, namely Ontology, Ethereum, OKXChain, and BNB Chain, with a testnet on Aptos.

$WING serves as the governance token of Wing Finance, utilized for voting on and determining the outcomes of WING Improvement Proposals (WIPs). Staking WING in Wing’s Insurance pool provides security/insurance to the protocol and suppliers, allowing stakers to earn rewards from the protocol.

Moreover, Wing has established partnerships with several prominent web3 entities, including CoinMarketCap, CoinGecko, DefiLlama, PolyNetwork, SushiSwap, and others. Notably, the Ontology project team fully supports Wing’s project development. Besides, the platform has not conducted token sales.

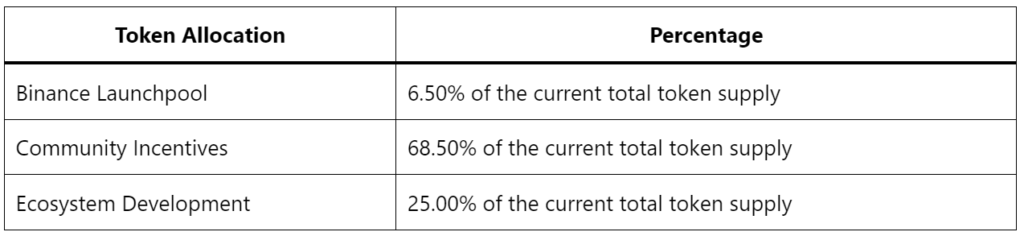

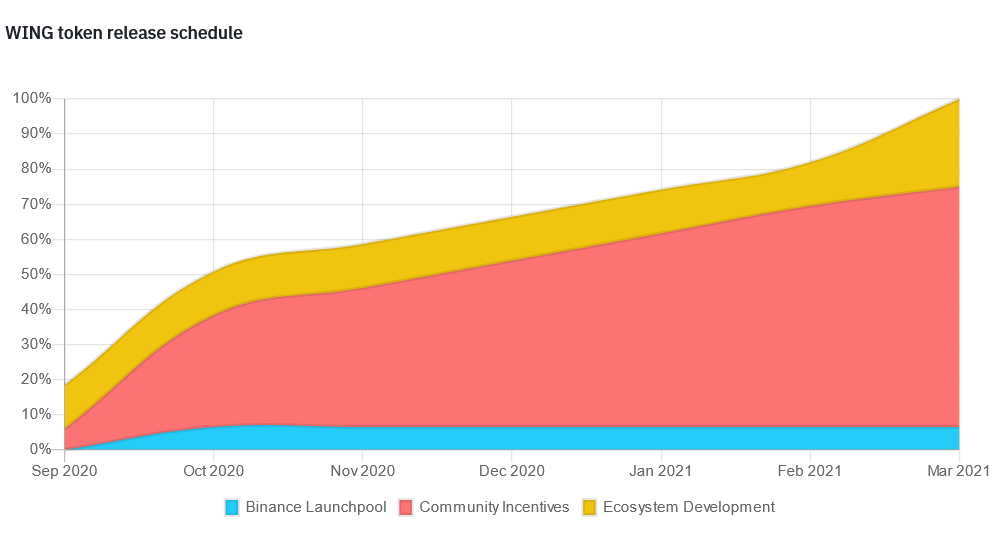

Tokenomics

Examining the token release schedule reveals no impending token unlocks, indicating a low likelihood of a supply shock.

Source: CoinGecko

The all-time high (ATH) for the WING token is $249.54. Presently, the token is trading at approximately $6.90, reflecting a decline of 97.3% from the ATH and a surge of 230.7% from the all-time low (ATL). Binance initially listed the token at $20. Consequently, the maximum ROI for an early investor acquiring the token from Binance is -65.50%.

Project Links

Project #3: Flamingo Finance ($FLM)

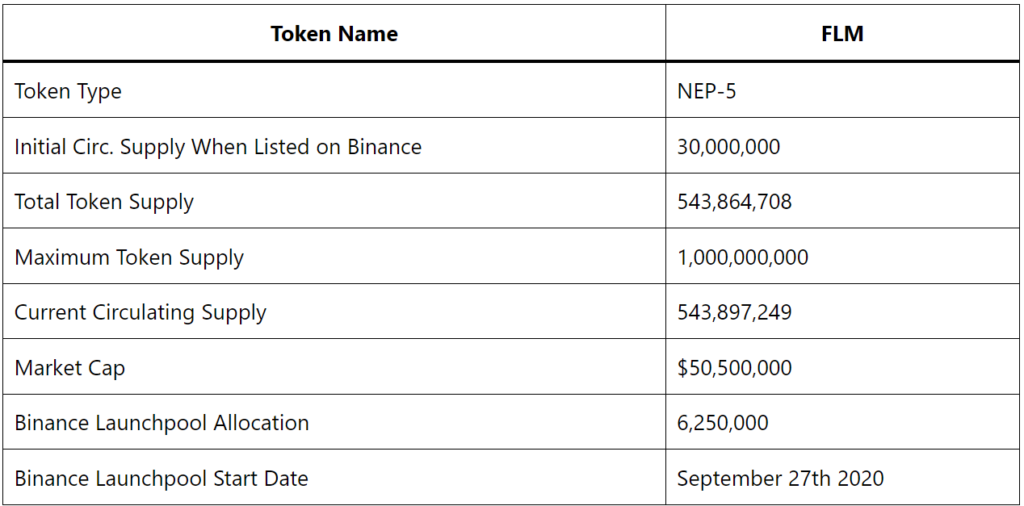

Flamingo Finance marked the third project featured on Binance Launchpool. Participants had the opportunity to stake their BNB or BUSD tokens in two distinct pools to farm FLM tokens over 30 days, with the farming initiative commencing on September 27, 2020. Subsequently, Binance listed FLM on September 28, 2020.

Flamingo Finance is a decentralized finance platform developed on the Neo blockchain, aiming to deliver a seamless and secure DeFi experience. The platform offers protocols for yield farming, staking, liquidity provision, DEX, and more.

Leveraging the capabilities of the Neo blockchain, Flamingo Finance amalgamates innovation, scalability, and security, establishing a robust ecosystem for diverse financial offerings.

Moreover, Flamingo offers FUSD, a collateralized synthetic stablecoin pegged to the USD’s price. LP token stakers can mint FUSD against their staked LP tokens, maintaining the actual collateralization ratio above the liquidation collateralization ratio. Users receive FLM in proportion to the amount of FUSD minted, with FLM rewards claimable only when the user’s actual collateralization ratio surpasses the target collateralization ratio.

Flamingo Finance emphasizes a user-friendly interface and intuitive design, ensuring accessibility for newcomers and seasoned crypto enthusiasts.

Besides, the Neo project team fully supports the development of Flamingo Finance, and the project has not conducted any token sales.

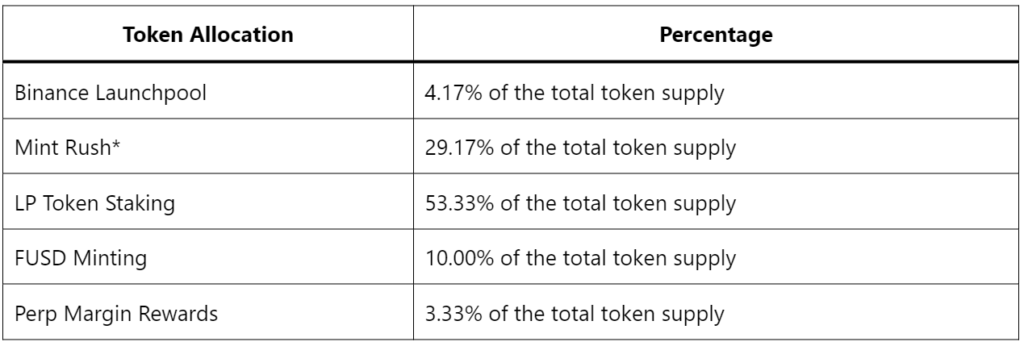

Tokenomics

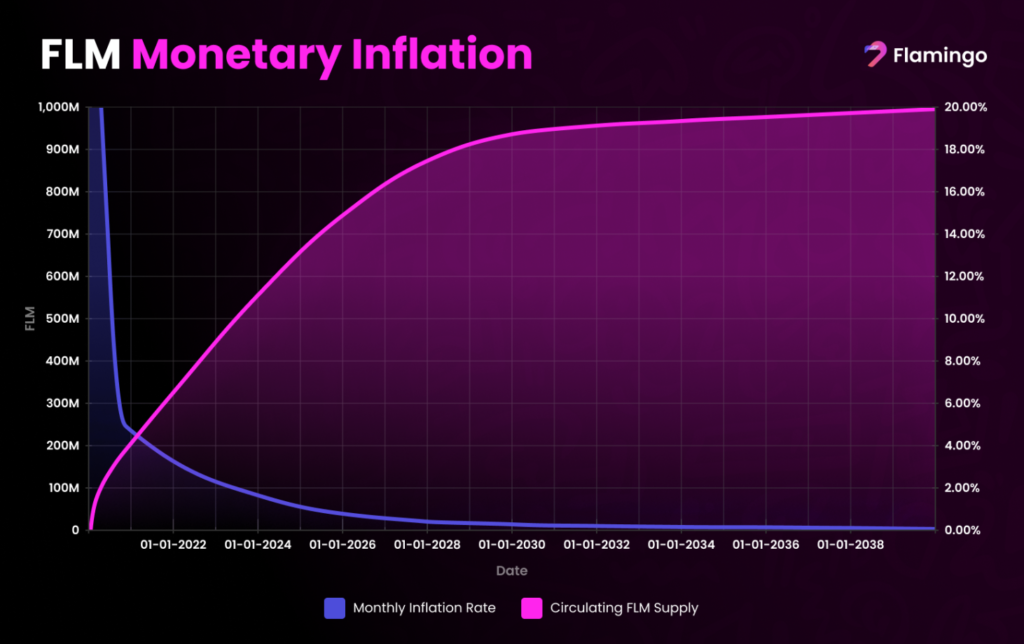

Flamingo established a strict cap of 1 billion FLM tokens to be minted and released into circulation within the next two decades. The entire supply is set to be fully minted and circulated by the conclusion of 2039. Currently, approximately 543.86 million FLM tokens, representing about half of the total supply, have been minted and are in circulation.

Source: Flamingo

Moreover, new FLM tokens are generated in real-time and rewarded to Flamingo platform users for contributing liquidity or holding a portion of the DEX-Traded Fund (DTF), known as ‘Flamingo Flund.’ While this continuous minting and rewarding create inherent token inflation, the inflation rate is not infinite and gradually decreases over time.

In October 2020, the first full month of minting post-platform release, the annual inflation rate of FLM stood at 100%, given that the platform minted all FLM in circulation during that month. Subsequently, the inflation rate has steadily declined each month.

In April 2022, the monthly inflation rate of FLM was 3.2%, dropping to 3.1% in May 2022 and further decreasing to 2.55% in December 2022. Presently, the rate stands at 2.34%. This monthly inflation rate will continue to decrease until January 2033, with subsequent drops in January 2037 and October 2039, leading to the completion of minting all 1 billion FLM tokens by the end of 2039.

Source: CoinGecko

The FLM token has experienced a 95.6% decrease from its ATH and an 84.2% increase from its ATL. Binance initially listed FLM at $0.3; the current trading price is $0.09. Consequently, the maximum ROI for an early investor acquiring the token from Binance would be -70.00%.

Project Links

Conclusion

Platforms such as Binance Launchpool are increasingly gaining prominence within specific niches in web3.

Binance Launchpool innovatively generates value and liquidity from locked funds, supporting redemption anytime and providing flexibility and freedom to investors, users, and communities.

On the other hand, it facilitates quality projects to broaden their token distribution to a larger audience. Clearly, Binance Launchpool is a complex solution benefiting both parties.

Our only qualm is that there are very few projects on Binance Launchpool!

Anyhow, our exploration of Binance Launchpool projects, including Bella Protocol, Wing, and Flamingo Finance, has shed light on these initiatives’ profitability and price mechanics.

- Bella Protocol is an aggregated user interface for existing DeFi protocols, with an ROI of -6.67%.

- Wing, a credit-based cross-chain DeFi lending platform, shows an ROI of -65.50%.

- Meanwhile, Flamingo, an interoperable full-stack DeFi protocol on the Neo blockchain, displays an ROI of -70.00%.

However, as is inherent in all crypto initiatives, remaining aware of potential pitfalls is crucial. While some projects may soar, others might encounter challenges or setbacks. Therefore, exercising caution and approaching any new crypto or launch pool with vigilance is essential. Always DYOR!

Stay tuned for reports on the remaining projects!

Found value in the insights shared here? Check out our YouTube and Twitter, loaded with content meant to educate and entertain.

Follow our Telegram for a sneak peek at alpha; for an even deeper dive, join our Patreon community, where we share exclusive alpha for you to be the ‘early bird.’

Follow us today, and let’s explore Web3 together!