Welcome to The Satsurday, your go-to source for the latest in Bitcoin and cryptocurrency news , regulations, and adoption. This week, we delve into key metrics influencing Bitcoin’s market, along with notable regulatory updates and adoption news.

In this week’s edition of The Satsurday, we dive into critical updates surrounding the Bitcoin ecosystem. From regulatory adoption to miner status, here’s what you need to know:

Market Overview

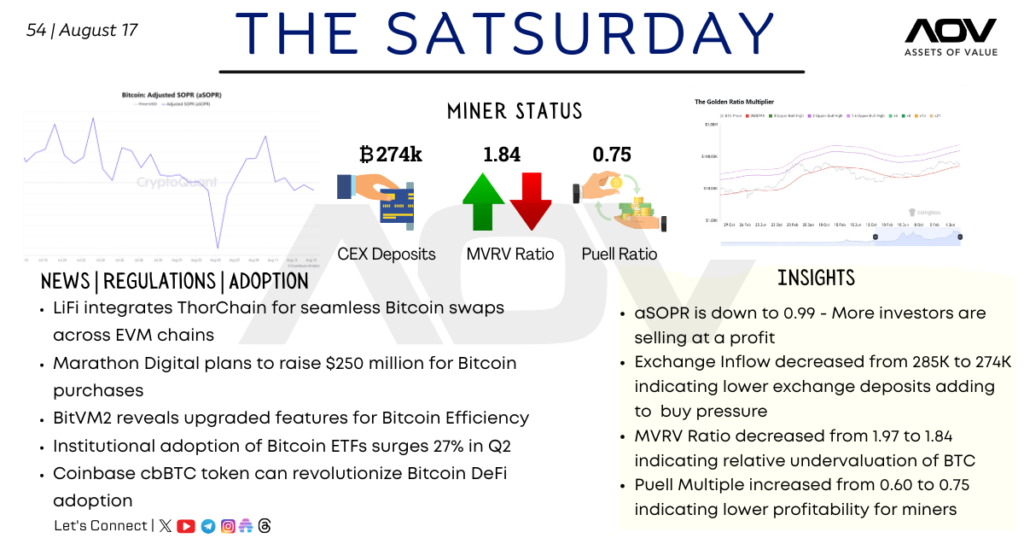

- Exchange Deposits (CEX): Bitcoin exchange deposits have decreased slightly, dropping from 285K to 274K. This decrease in inflows indicates lower sell pressure, signaling that fewer holders are sending their Bitcoin to exchanges.

- MVRV Ratio: The MVRV ratio has declined from 1.97 to 1.84. This ratio indicates that Bitcoin might be undervalued, suggesting an opportunity for accumulation.

- Puell Ratio: The Puell Ratio has increased from 0.60 to 0.75, pointing to higher profitability for miners, which could result in increased selling pressure in the near future.

Key Insights

- aSOPR Drops to 0.99: The adjusted SOPR (Spent Output Profit Ratio) has dropped to 0.99. This means that more investors are selling Bitcoin at a profit, indicating a potential top in the current rally.

- Lower Exchange Inflows: The decrease in exchange inflows suggests that fewer investors are moving Bitcoin to exchanges to sell, which could mean the market is preparing for a bullish continuation as buy pressure builds.

- MVRV Ratio Decline: The fall in the MVRV ratio reinforces the idea that Bitcoin is currently undervalued, creating potential buying opportunities.

- Puell Multiple Rise: As miner profitability increases, there might be some sell pressure from miners taking profits.

News, Regulations & Adoption

- LiFi Integrates ThorChain: LiFi has integrated ThorChain to enable seamless Bitcoin swaps across Ethereum Virtual Machine (EVM) chains, enhancing interoperability within the DeFi space.

- Marathon Digital’s Expansion: Marathon Digital Holdings plans to raise $250 million for Bitcoin purchases, signaling bullish institutional sentiment.

- BitVM2 Upgrades: BitVM2 has unveiled upgraded features aimed at improving Bitcoin network efficiency, contributing to better scalability and lower transaction costs.

- Bitcoin ETFs Surge: Institutional adoption of Bitcoin ETFs has surged by 27% in Q2, indicating increasing confidence from large-scale investors.

- Coinbase’s cbBTC Token: Coinbase’s cbBTC token could potentially revolutionize Bitcoin DeFi adoption by offering more decentralized financial solutions.

Conclusion

This week’s data suggests a market in a state of consolidation, with reduced sell pressure from exchanges and growing interest from institutional investors. As the MVRV ratio indicates undervaluation, and miner profitability rises, the current environment may offer strategic entry points for both retail and institutional investors. Additionally, continuous innovation in the DeFi space and increasing ETF adoption strengthen the long-term outlook for Bitcoin.

Found value in the insights shared here? Check out our YouTube and Twitter, loaded with content meant to educate and entertain.

Follow our Telegram for a sneak peek at alpha; for an even deeper dive, join our Patreon community, where we share exclusive alpha for you to be the ‘early bird.’

Follow us today, and let’s explore Web3 together!