Welcome to The Satsurday, your go-to source for the latest in Bitcoin and cryptocurrency news , regulations, and adoption. This week, we delve into key metrics influencing Bitcoin’s market, along with notable regulatory updates and adoption news.

This week’s edition of “The Satsurday” dives into the latest developments in the Bitcoin ecosystem, highlighting key insights into miner status, regulatory changes, and adoption trends. As Bitcoin continues to navigate the complex market dynamics, these factors provide a comprehensive overview of where the cryptocurrency stands and what might be on the horizon.

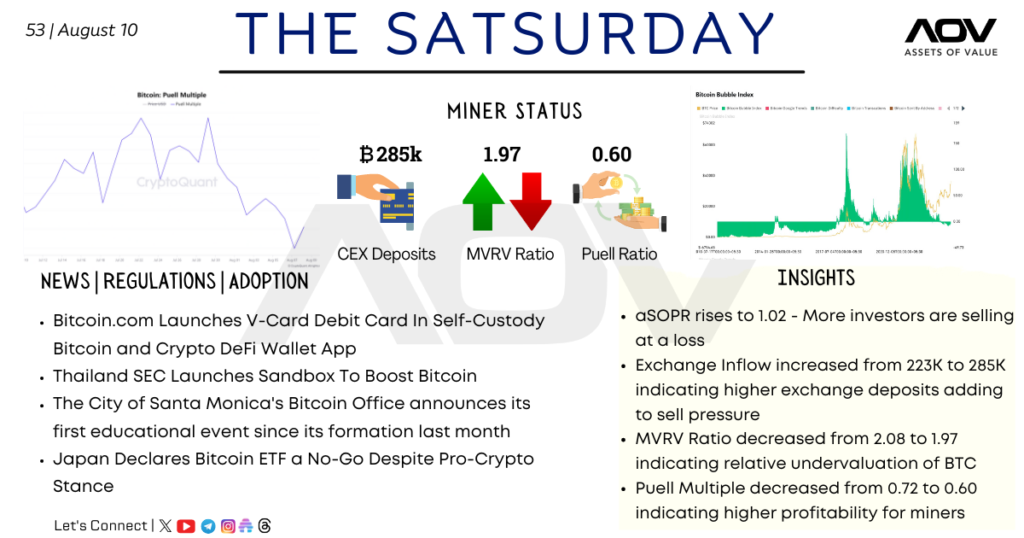

Miner Status Overview

- CEX Deposits: The total exchange inflow increased to 285K BTC, up from 223K. This rise suggests a heightened sell pressure as more Bitcoin is being deposited into exchanges, possibly indicating that investors are positioning themselves for potential market downturns.

- MVRV Ratio: The Market Value to Realized Value (MVRV) ratio has decreased from 2.08 to 1.97. A lower MVRV ratio generally points towards Bitcoin being undervalued relative to its historical norms, hinting that the market may be nearing a more attractive buying point for long-term investors.

- Puell Ratio: The Puell Multiple, which measures miner profitability, has dropped to 0.60 from 0.72. This decrease indicates that miners are experiencing higher profitability, which could lead to sustained or increased mining activity.

News | Regulations | Adoption

- Bitcoin.com Launches V-Card Debit Card: In a significant move towards increasing cryptocurrency adoption, Bitcoin.com has introduced a V-Card Debit Card within its self-custody Bitcoin and Crypto DeFi Wallet App. This development provides users with a more seamless way to spend their crypto assets directly from their wallets.

- Thailand SEC Launches Bitcoin Sandbox: The Thai Securities and Exchange Commission (SEC) has launched a regulatory sandbox specifically aimed at boosting Bitcoin adoption. This initiative is designed to foster innovation while ensuring compliance with local regulations.

- Santa Monica’s Bitcoin Office Hosts First Educational Event: The City of Santa Monica’s Bitcoin Office has announced its first educational event since its inception last month. This event underscores the city’s commitment to fostering a better understanding of Bitcoin and its potential economic impacts.

- Japan’s Stance on Bitcoin ETF: Despite a generally pro-crypto stance, Japan has declared that a Bitcoin ETF (Exchange-Traded Fund) will not be allowed. This decision reflects the country’s cautious approach towards fully integrating Bitcoin into its mainstream financial markets.

Key Insights

- aSOPR Rises to 1.02: The Adjusted Spent Output Profit Ratio (aSOPR) has risen, suggesting that more investors are selling at a loss. This metric often signals a period of capitulation in the market, where weaker hands are exiting their positions.

- Exchange Inflow Surge: The increase in exchange deposits from 223K to 285K BTC suggests growing sell pressure, possibly leading to short-term bearish sentiment in the market.

- MVRV Ratio Decline: The drop in the MVRV ratio to 1.97 indicates that Bitcoin is currently undervalued, potentially offering a buying opportunity for investors looking to accumulate at lower price levels.

- Puell Multiple Decrease: The decline in the Puell Multiple to 0.60 highlights increased miner profitability, which could result in continued or even ramped-up mining activity, sustaining network security and activity.

As Bitcoin continues to mature as an asset, these metrics and developments provide crucial insights into the broader market sentiment and adoption trajectory. Keep an eye on these indicators as they will likely play a significant role in shaping Bitcoin’s path forward.

Found value in the insights shared here? Check out our YouTube and Twitter, loaded with content meant to educate and entertain.

Follow our Telegram for a sneak peek at alpha; for an even deeper dive, join our Patreon community, where we share exclusive alpha for you to be the ‘early bird.’

Follow us today, and let’s explore Web3 together!