Welcome to The Satsurday, your go-to source for the latest in Bitcoin and cryptocurrency news , regulations, and adoption. This week, we delve into key metrics influencing Bitcoin’s market, along with notable regulatory updates and adoption news.

1. Bitcoin News: Regulations and Adoption

A series of pivotal developments are driving Bitcoin’s integration into mainstream finance and services:

- Commerzbank and DZ Bank Lead Crypto Integration: These two major German banks have spearheaded a Bitcoin revolution by introducing Bitcoin services to their clients. This move showcases the growing institutional interest in digital assets within the regulated banking framework in Europe.

- Bitcoin Layer 2 (L2) Innovations: L2 Bob launched a new “one-click” Bitcoin staking solution, making Bitcoin more accessible to the masses by simplifying the process for everyday users. Layer 2 solutions are seen as vital to increasing transaction speed and reducing fees on the Bitcoin network.

- Bhutan’s Surprising BTC Holdings: An unexpected revelation is Bhutan’s BTC holdings, which are reportedly twice that of El Salvador, the country widely recognized for its aggressive Bitcoin adoption. Bhutan’s large stake demonstrates how smaller nations are leveraging cryptocurrency as part of their financial strategies.

- Louisiana State Government Embraces Bitcoin Lightning Network: In an encouraging nod to digital currency, the Louisiana state government now accepts Bitcoin Lightning payments, signaling progress in Bitcoin’s usability for day-to-day transactions at a governmental level.

- HTX Integrates Lightning Network: HTX’s integration of the Lightning Network for faster Bitcoin payments provides users with lower transaction costs and faster settlement, further enhancing Bitcoin’s use as a viable method for small and large payments alike.

2. Miner Status: Vital On-Chain Metrics

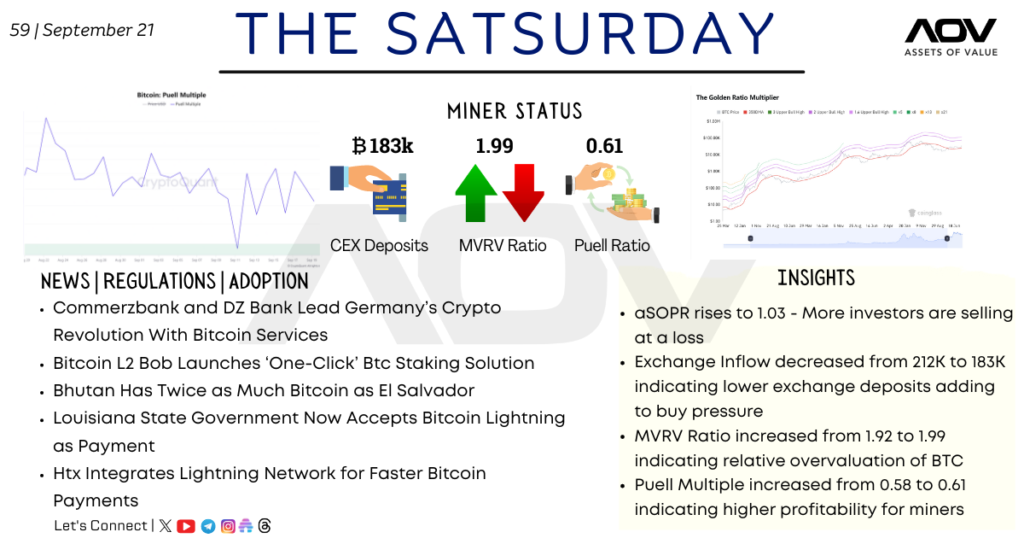

The miner ecosystem remains a crucial component of Bitcoin’s overall health, with key metrics offering insights into the network’s sustainability and profitability:

- Centralized Exchange (CEX) Deposits: Bitcoin deposits on exchanges decreased to 183,000 BTC, indicating reduced selling pressure. The decline in exchange inflow could signify that investors are holding onto their BTC, anticipating future price increases.

- MVRV Ratio: The MVRV (Market Value to Realized Value) ratio has risen slightly from 1.92 to 1.99. A ratio above 1 implies that Bitcoin is relatively overvalued compared to its realized value, suggesting that there might be increased selling pressure as BTC holders seek to lock in profits.

- Puell Ratio: The Puell Multiple, an indicator of miner profitability, increased from 0.58 to 0.61, signaling higher profits for miners. This metric assesses the overall profitability of mining operations by comparing daily coin issuance to the 365-day average. Higher profitability tends to encourage further investment in mining infrastructure, supporting network growth.

3. Industry Insights: Market Sentiment & Trends

Several key insights reflect the current sentiment among Bitcoin investors and miners:

- aSOPR Increase to 1.03: The Adjusted Spent Output Profit Ratio (aSOPR) climbed to 1.03, indicating that more investors are selling at a loss. This ratio measures whether Bitcoin holders are selling their assets at a profit or a loss. An increase suggests that despite the minor losses, holders may anticipate further declines, prompting them to exit positions.

- Exchange Inflow Drops: Exchange inflows dropped from 212,000 BTC to 183,000 BTC. The reduced inflow to exchanges signals lower selling pressure and increased investor confidence in Bitcoin’s future price movements.

- MVRV Indicates BTC Overvaluation: The MVRV ratio’s slight uptick suggests that Bitcoin is currently overvalued. This ratio is a crucial indicator for potential sell-offs if the market deems the asset overbought.

- Higher Miner Profitability: The rising Puell Multiple highlights higher miner profitability, which could stimulate more mining activity, potentially increasing network security while raising the overall hash rate.

Conclusion

Bitcoin continues to see widespread global adoption, as illustrated by the progressive actions taken by Germany’s leading banks and governments like Louisiana embracing crypto-friendly payment methods. Meanwhile, the miner ecosystem shows signs of growth, with profitability on the rise, but caution remains as valuation metrics such as MVRV hint at potential overvaluation. The coming weeks will likely see heightened attention as Bitcoin moves through these developments amid fluctuating market conditions.

Found value in the insights shared here? Check out our YouTube and Twitter, loaded with content meant to educate and entertain.

Follow our Telegram for a sneak peek at alpha; for an even deeper dive, join our Patreon community, where we share exclusive alpha for you to be the ‘early bird.’

Follow us today, and let’s explore Web3 together!