Welcome to The Satsurday, your go-to source for the latest in Bitcoin and cryptocurrency news , regulations, and adoption. This week, we delve into key metrics influencing Bitcoin’s market, along with notable regulatory updates and adoption news.

News | Regulations | Adoption

- UK Parliament Introduces Bill to Recognize Bitcoin and Crypto as Personal Property

The UK government is taking significant steps toward recognizing Bitcoin and cryptocurrencies as personal property, which could bolster legal protections and encourage broader adoption. - Putin Acknowledges Russia as a Bitcoin Mining Leader

In a bold move, President Vladimir Putin has recognized Russia as a top Bitcoin mining nation. With over 54,000 BTC mined in 2023, Russia is positioning itself as a central player in the global Bitcoin mining scene. - Merlin Chain and BitcoinOS Partner to Unveil Zk-Powered Bitcoin Bridge

Merlin Chain and BitcoinOS have joined forces to launch a Zk-powered bridge that aims to enhance cross-chain interoperability, facilitating faster and more secure transactions within the Bitcoin ecosystem. - Bitcoin’s Hashrate Reaches 692 Eh/s, Nearing 700 Eh/s Milestone

Bitcoin’s network continues to grow stronger, with the hashrate reaching an impressive 692 Exahashes per second (Eh/s). This indicates an ever-growing security layer for Bitcoin transactions as miners push the network toward a new milestone.

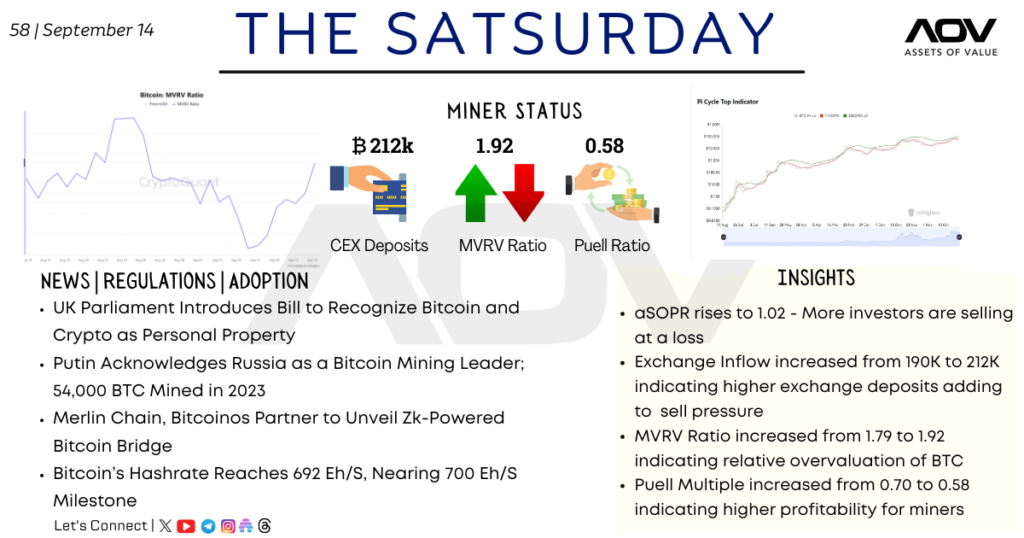

Miner Status

- CEX Deposits

CEX deposits saw an increase, with 212,000 BTC entering exchanges. This uptick suggests rising liquidity but also signals potential selling pressure as more coins are being moved to exchanges. - MVRV Ratio

The MVRV (Market Value to Realized Value) Ratio stands at 1.92, up from 1.79. This suggests that Bitcoin is somewhat overvalued, as the market price is higher than the realized price. - Puell Ratio

The Puell Ratio is currently at 0.58, indicating increased profitability for Bitcoin miners. This metric compares miner revenue to historical norms, showing favorable conditions for mining.

Insights

- aSOPR Rises to 1.02

The Adjusted Spent Output Profit Ratio (aSOPR) has risen to 1.02, indicating that more investors are selling Bitcoin at a loss, reflecting short-term bearish sentiment in the market. - Exchange Inflow Jumps to 212K BTC

Bitcoin exchange inflows have increased from 190,000 BTC to 212,000 BTC. This rise in exchange deposits often correlates with an increase in sell pressure, as more BTC becomes available on the market. - MVRV Ratio Trends Upward

The rise in the MVRV Ratio from 1.79 to 1.92 implies that Bitcoin’s current price may be overvalued relative to its historical average, which could suggest potential market correction. - Puell Multiple Sees an Increase

The Puell Multiple, now at 0.58, has grown from 0.70. This indicates higher profitability for miners as their revenues are on the rise compared to the long-term average.

Conclusion

Bitcoin’s network continues to strengthen, with its hashrate nearing the 700 Eh/s mark and increased mining profitability reflected in the Puell Ratio. However, the surge in CEX deposits and rising MVRV ratios suggest caution as the market might face selling pressure in the near future. Regulatory advancements, like the UK’s recognition of crypto as personal property, signal a positive trend for Bitcoin adoption on a global scale.

Found value in the insights shared here? Check out our YouTube and Twitter, loaded with content meant to educate and entertain.

Follow our Telegram for a sneak peek at alpha; for an even deeper dive, join our Patreon community, where we share exclusive alpha for you to be the ‘early bird.’

Follow us today, and let’s explore Web3 together!