Welcome to The Satsurday, your go-to source for the latest in Bitcoin and cryptocurrency news , regulations, and adoption. This week, we delve into key metrics influencing Bitcoin’s market, along with notable regulatory updates and adoption news.

Market Insights

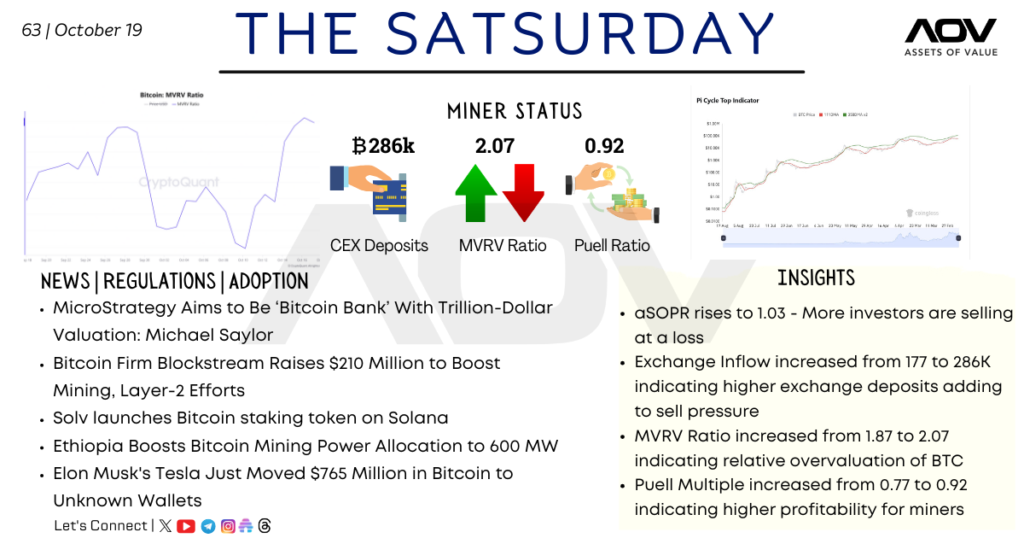

- CEX Deposits:

- Value: 309K BTC

- An increase in exchange deposits indicates that more investors are potentially preparing to sell, adding to market sell pressure.

- MVRV Ratio:

- Current: 2.08 (slight increase from 2.07)

- The rising MVRV ratio suggests Bitcoin’s relative overvaluation, which could lead some investors to consider taking profits in the near term.

- Puell Ratio:

- Current: 0.85 (down from 0.92)

- A decline in the Puell ratio implies lower miner profitability, which may influence miner behavior, potentially reducing selling pressure from miners.

News | Regulations | Adoption

- Cardano’s BitcoinOS Integration:

Cardano has unlocked $1.3 trillion in Bitcoin liquidity with the integration of BitcoinOS, offering enhanced interoperability and expanding Bitcoin’s potential use cases. - Microsoft’s Bitcoin Proposal Vote:

Microsoft is encouraging shareholders to vote against a proposal that would classify Bitcoin as a diversification investment, marking a critical stance from a major tech player. - SEC Approval for Spot Bitcoin ETFs:

The U.S. Securities and Exchange Commission (SEC) has approved 11 spot Bitcoin ETFs to trade on the New York Stock Exchange (NYSE), paving the way for institutional investors to gain regulated exposure to Bitcoin. - Bitcoin Hashrate at All-Time High:

Bitcoin’s network security is at an all-time high, driven by increasing hashrate, reinforcing network resilience and security.

Analyst Insights

- aSOPR Ratio: Down to 1.02, indicating that more investors are selling at a profit.

- Exchange Inflow: Increased from 286K to 309K, suggesting heightened sell pressure as more Bitcoin moves to exchanges.

- MVRV and Puell Ratio Analysis: A rise in MVRV alongside a decrease in Puell ratio suggests potential market volatility, as BTC appears overvalued while miners face profitability challenges.

Conclusion

The increase in institutional adoption, along with regulatory approvals, highlights a maturing market. However, key metrics suggest possible sell pressure in the short term. Investors should monitor these indicators closely to navigate potential shifts in Bitcoin’s valuation.

Found value in the insights shared here? Check out our YouTube and Twitter, loaded with content meant to educate and entertain.

Follow our Telegram for a sneak peek at alpha; for an even deeper dive, join our Patreon community, where we share exclusive alpha for you to be the ‘early bird.’

Follow us today, and let’s explore Web3 together!