Welcome to the latest edition of The Satsurday Weekly, your source for Bitcoin market movements, technology advances, and sentiment. Let’s dive into the significant events and numbers that have characterized the past week.

Edition 68 | November 23

The cryptocurrency market continues to buzz with key developments, regulatory updates, and evolving market metrics. Here’s a breakdown of the latest insights from the crypto landscape.

Key News Highlights

- Pro-Bitcoin Advocacy in U.S. Politics

Former President Donald Trump has nominated a pro-Bitcoin candidate from Cantor Fitzgerald as the potential Commerce Secretary. This move is expected to spark discussions about Bitcoin’s role in future U.S. economic strategies. - Poland Embraces Bitcoin

A Polish presidential candidate has pledged to establish a strategic Bitcoin reserve if elected, signaling growing geopolitical interest in the cryptocurrency as a financial safeguard. - Michael Saylor Eyes Microsoft Board

MicroStrategy founder Michael Saylor plans to pitch Bitcoin investment strategies to the Microsoft board, reinforcing his position as a staunch Bitcoin advocate. - Coinbase and WBTC Delisting

In a surprising escalation of tokenized Bitcoin concerns, Coinbase has announced plans to delist Wrapped Bitcoin (WBTC), raising eyebrows about the implications for decentralized finance and tokenized assets.

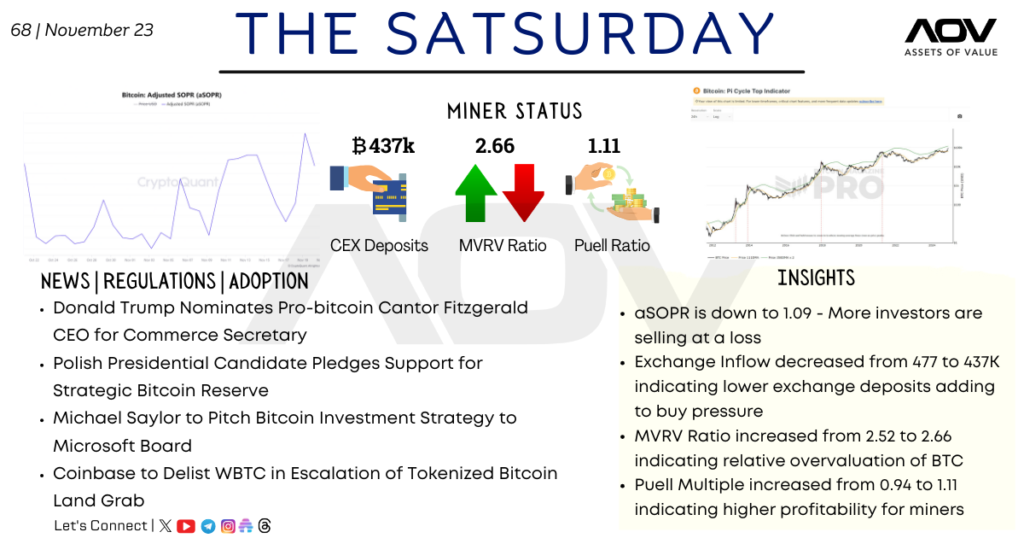

Market Metrics and Miner Status

- CEX Deposits

Exchange inflows have dropped from 477K BTC to 437K BTC, suggesting reduced sell pressure and a potential increase in accumulation among investors. - MVRV Ratio

The MVRV ratio climbed from 2.52 to 2.66, signaling that Bitcoin may be moving towards an overvalued state relative to its historical price trends. - Puell Ratio

The Puell Multiple rose from 0.94 to 1.11, pointing to higher profitability for Bitcoin miners and potential sell pressure if miners choose to take profits.

Insights

- aSOPR (Adjusted SOPR): The metric has dropped to 1.09, indicating that more investors are selling at a loss—a sign of weaker market sentiment.

- Exchange Activity: Lower exchange deposits suggest increasing buy pressure as traders withdraw BTC to hold in private wallets.

- Profitability Metrics: Rising profitability for miners aligns with the upward movement of the Puell Multiple, which could influence miner behavior and market dynamics.

Implications

This week’s developments reflect a mix of bullish and cautious sentiment. While adoption and advocacy for Bitcoin grow across political and corporate fronts, market participants remain wary of overvaluation and potential sell-offs by miners. The reduced exchange inflows and rising MVRV ratio indicate a potential shift in market momentum, possibly leading to a new accumulation phase.

As always, staying informed and vigilant in this ever-evolving space is key for both investors and stakeholders.

Found value in the insights shared here? Check out our YouTube and Twitter, loaded with content meant to educate and entertain.

Follow our Telegram for a sneak peek at alpha; for an even deeper dive, join our Patreon community, where we share exclusive alpha for you to be the ‘early bird.’

Follow us today, and let’s explore Web3 together!