Welcome to the latest edition of The Satsurday Weekly, your source for Bitcoin market movements, technology advances, and sentiment. Let’s dive into the significant events and numbers that have characterized the past week.

News | Regulations | Adoption

- UK Pension Scheme Embraces Bitcoin

In a historic step towards institutional crypto adoption, a UK pension scheme has integrated Bitcoin, signaling increased confidence from traditional financial institutions in cryptocurrency. - Coinbase Launches Wrapped Bitcoin (CBBTC)

Coinbase has introduced a new wrapped Bitcoin (CBBTC) in partnership with Solana DeFi integrations. This new development could boost liquidity and cross-chain interoperability for Bitcoin holders. - Bitcoin Futures Open Interest Reaches New Heights

Bitcoin futures have hit an all-time high with open interest surpassing $46.05 billion, reflecting increased market activity and heightened trader interest in Bitcoin futures as a speculative and hedging instrument. - Deutsche Telekom’s Bitcoin Mining Pilot

Deutsche Telekom is set to test Bitcoin mining using surplus energy, adding to the list of innovative approaches companies are exploring to make crypto mining more sustainable.

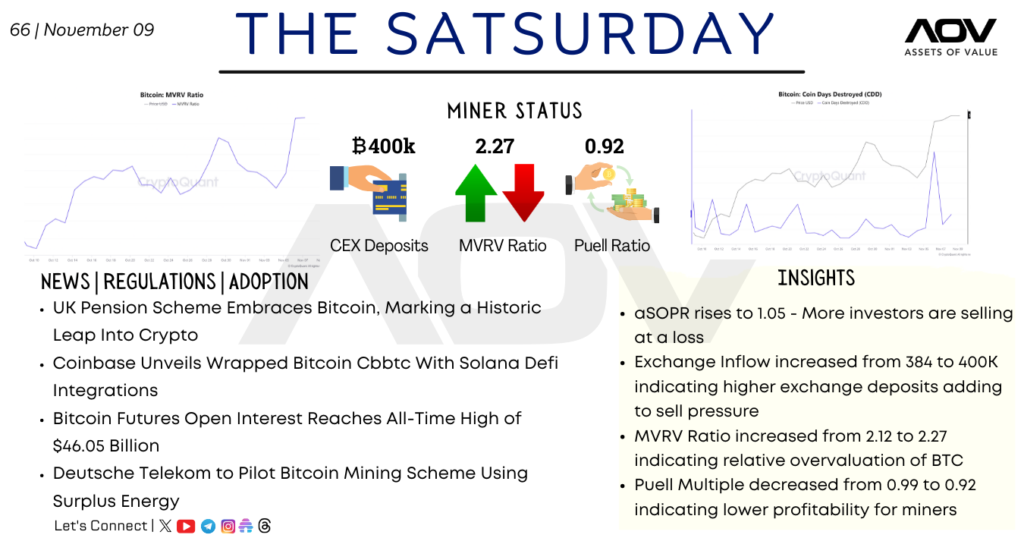

Miner Status

- CEX Deposits: ₿400k

An increase in centralized exchange (CEX) deposits suggests more Bitcoin is being moved to exchanges, potentially indicating upcoming sell pressure from traders. - MVRV Ratio: 2.27

The MVRV ratio, which measures the average profit/loss of Bitcoin holders, has increased from 2.12 to 2.27. This rise signals a potential overvaluation of Bitcoin, suggesting that holders might start taking profits. - Puell Ratio: 0.92

The Puell Ratio, an indicator of miner profitability, has decreased from 0.99 to 0.92. This decline suggests that miners are facing lower profitability, which could impact their operations if it continues.

Market Insights

- aSOPR Rises to 1.05

The adjusted Spent Output Profit Ratio (aSOPR) has increased to 1.05, indicating more investors are selling at a loss. This suggests that some holders may be capitulating due to market conditions. - Exchange Inflows Surge

Exchange inflows have jumped from 384,000 BTC to 400,000 BTC. This increase suggests that more holders are transferring Bitcoin to exchanges, potentially adding to sell pressure. - MVRV Ratio Indicates Overvaluation

The rise in the MVRV ratio from 2.12 to 2.27 implies that Bitcoin may be overvalued relative to historical averages, which could prompt investors to realize profits and trigger a market correction. - Puell Multiple Decrease

The decrease in the Puell Multiple from 0.99 to 0.92 indicates reduced profitability for miners. This drop could lead to reduced mining activity if profitability remains low, potentially affecting Bitcoin’s hash rate and network security.

Conclusion

The crypto market is witnessing a complex mix of adoption, regulatory moves, and changing miner dynamics. The rise in institutional interest, combined with shifts in miner profitability and market indicators like the MVRV and Puell ratios, highlights both opportunities and potential risks. With more Bitcoin flowing into exchanges and a slight uptick in investor losses, traders should remain vigilant for potential volatility in the near term.

Found value in the insights shared here? Check out our YouTube and Twitter, loaded with content meant to educate and entertain.

Follow our Telegram for a sneak peek at alpha; for an even deeper dive, join our Patreon community, where we share exclusive alpha for you to be the ‘early bird.’

Follow us today, and let’s explore Web3 together!