Welcome to the latest edition of The Satsurday Weekly, your source for Bitcoin market movements, technology advances, and sentiment. Let’s dive into the significant events and numbers that have characterized the past week.

1. News | Regulations | Adoption

Table of Contents

Key Headlines:

- SEC Approves First Hybrid Bitcoin-Ethereum ETFs

The SEC has greenlit the launch of hybrid Bitcoin-Ethereum ETFs from Hashdex and Franklin Templeton. This marks a significant step toward wider crypto investment options in regulated markets. - Bitcoin DeFi Project Solv to Launch Native Token on Hyperliquid

Solv, a decentralized finance platform, announced plans to launch its native token on Hyperliquid, aiming to enhance liquidity and interoperability across its network. - Yellow Card and Lightspark Join Forces

The two companies partnered to enable instant Bitcoin transfers across Africa, expanding financial inclusion on the continent. - Bitcoin-to-Gold Ratio Hits Historic Peak

Bitcoin’s value relative to gold has soared, setting a new milestone as the year-end rally keeps BTC bullish.

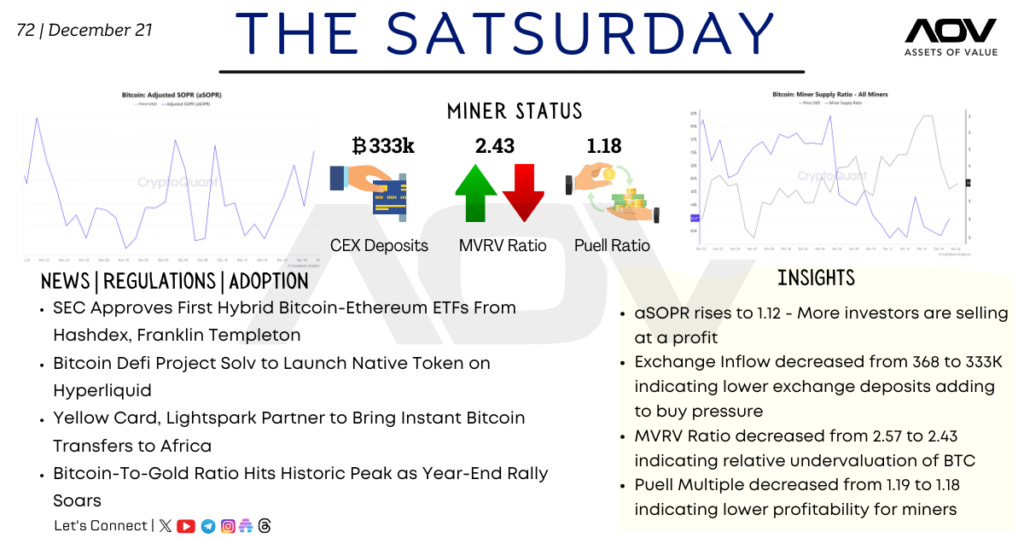

2. Miner Status

Key Metrics:

- CEX Deposits: ₿333K

Exchange inflows have decreased from ₿368K to ₿333K, reducing selling pressure and suggesting growing interest in holding Bitcoin. - MVRV Ratio: 2.43 (Down from 2.57)

A declining MVRV ratio points to Bitcoin being relatively undervalued, which may indicate a buying opportunity for investors. - Puell Ratio: 1.18 (Slight Decrease from 1.19)

The lower Puell ratio reflects reduced miner profitability, which could impact miner behavior and Bitcoin’s supply dynamics.

3. Insights

- aSOPR Rises to 1.12

The adjusted SOPR (Spent Output Profit Ratio) increase indicates that more investors are selling Bitcoin at a profit, signaling profit-taking activity during the rally. - Exchange Inflow Declines

The decrease in exchange deposits from ₿368K to ₿333K reflects reduced selling pressure, possibly driven by higher confidence in Bitcoin’s current value trajectory. - MVRV Ratio Highlights Undervaluation

The drop in the MVRV ratio from 2.57 to 2.43 suggests that Bitcoin is undervalued, potentially attracting long-term buyers. - Puell Ratio and Miner Profitability

The slight drop in the Puell ratio from 1.19 to 1.18 hints at lower miner profitability, which could influence the pace of mining activity and Bitcoin supply in the near future.

Closing Thoughts

This week’s developments indicate a mix of bullish market sentiment and cautious miner behavior. The SEC’s approval of hybrid ETFs and rising Bitcoin-to-gold ratio underscore growing institutional interest. Meanwhile, key metrics like the MVRV and Puell ratios suggest potential opportunities for strategic investors.