Welcome to the latest edition of The Satsurday Weekly, your source for Bitcoin market movements, technology advances, and sentiment. Let’s dive into the significant events and numbers that have characterized the past week.

Bitcoin Futures and Institutional Momentum

Table of Contents

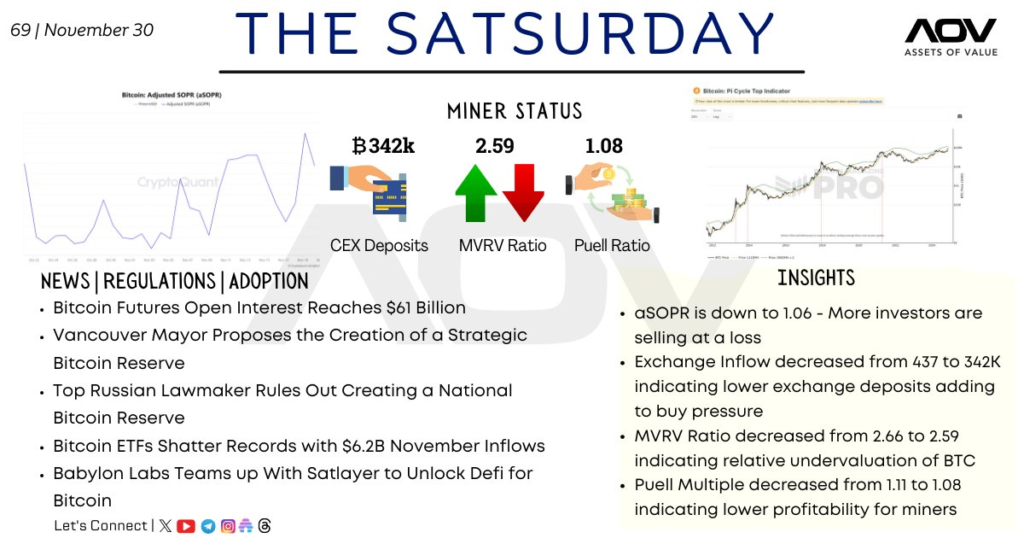

Bitcoin Futures Open Interest has surged to a staggering $61 billion, marking a significant milestone in institutional adoption. This reflects heightened interest in Bitcoin as a tradable asset, further strengthening its position as a mainstream financial instrument.

Adoption and Regulatory Developments

- Vancouver’s Vision for Bitcoin Reserves: The Mayor of Vancouver has proposed the creation of a strategic Bitcoin reserve, showcasing a forward-thinking approach toward digital assets.

- Russia Dismisses National Bitcoin Reserves: On the contrary, a top Russian lawmaker has ruled out creating a national Bitcoin reserve, signaling a conservative stance on cryptocurrency adoption.

- Bitcoin ETFs Break Records: November inflows into Bitcoin ETFs reached an impressive $6.2 billion, underscoring growing investor confidence in these investment vehicles.

- Babylon Labs Joins Forces with Satlayer: The collaboration aims to unlock DeFi solutions for Bitcoin, expanding its utility beyond store-of-value and peer-to-peer transactions.

Market Metrics and Miner Status

- CEX Deposits: Centralized exchange (CEX) deposits decreased from 437K BTC to 342K BTC. This decline suggests reduced selling pressure and a potential uptick in buying demand.

- MVRV Ratio: The Market Value to Realized Value (MVRV) ratio dipped from 2.66 to 2.59, indicating that Bitcoin is relatively undervalued at current levels.

- Puell Ratio: The Puell Multiple dropped slightly from 1.11 to 1.08, reflecting lower profitability for miners amid current price conditions.

Insights on Investor Behavior

- aSOPR Analysis: The Adjusted Spent Output Profit Ratio (aSOPR) has decreased to 1.06. Revealing that more investors are realizing losses on their trades. This could point to a consolidation phase or cautious market sentiment.

- Exchange Inflows: The notable decline in exchange inflows signals a reduction in Bitcoin being sent to exchanges for liquidation. Hinting at growing investor confidence and accumulation behavior.

- MVRV and Puell Ratio Trends: Both indicators suggest Bitcoin is undervalued, which may set the stage for renewed interest among long-term investors and miners.

Market Outlook

Bitcoin’s near-term trajectory is promising due to record-breaking ETF inflows, reduced CEX deposits, and improved valuation metrics like MVRV and Puell ratios. However, the drop in miner profitability and increasing realized losses reflect ongoing market challenges.

As the ecosystem evolves, developments like DeFi integration via Babylon Labs and regulatory shifts will likely play a crucial role in shaping Bitcoin’s adoption and price movement in the months ahead.

Found value in the insights shared here? Check out our YouTube and Twitter, loaded with content meant to educate and entertain.

Follow our Telegram for a sneak peek at alpha; for an even deeper dive, join our Patreon community, where we share exclusive alpha for you to be the ‘early bird.’

Follow us today, and let’s explore Web3 together!