Welcome to the latest edition of The Satsurday Weekly, your source for Bitcoin market movements, technology advances, and sentiment. Let’s dive into the significant events and numbers that have characterized the past week.

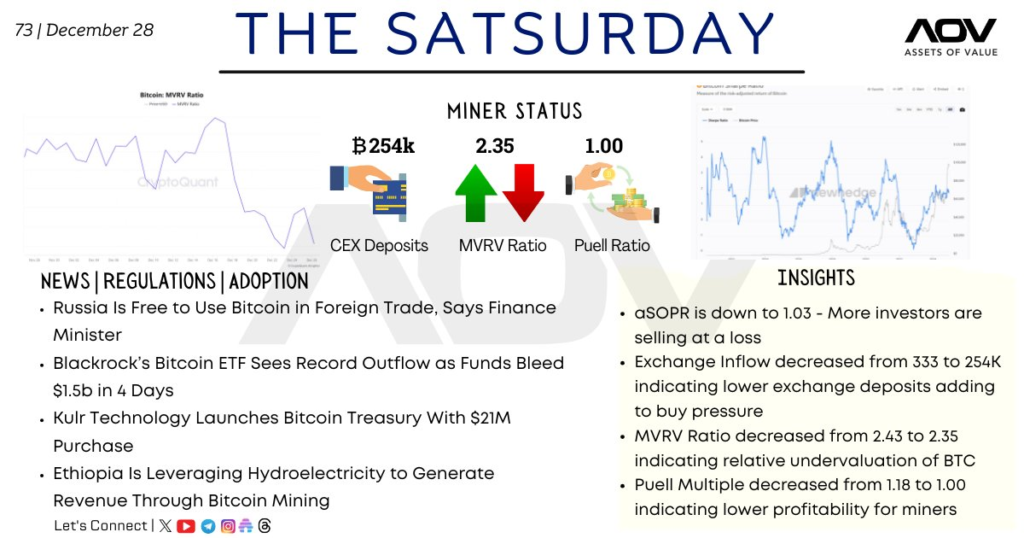

Miner Status

- CEX Deposits: Bitcoin deposits to centralized exchanges (CEX) have decreased to 254,000 BTC, indicating reduced selling pressure and potentially signaling lower liquidity entering the market.

- MVRV Ratio: The Market Value to Realized Value (MVRV) ratio has dropped to 2.35 from 2.43, suggesting a relative undervaluation of Bitcoin. Historically, lower MVRV ratios signal potential buying opportunities.

- Puell Ratio: The Puell Ratio, measuring miner profitability, has declined to 1.00 from 1.18. This drop implies reduced profitability for miners, which could lead to changes in mining activity and Bitcoin’s supply dynamics.

News | Regulations | Adoption

- Russia Embraces Bitcoin: Russia’s Finance Minister announced that Bitcoin is now free to be used in foreign trade, opening new opportunities for cryptocurrency adoption in international commerce.

- BlackRock Bitcoin ETF Outflows: BlackRock’s Bitcoin ETF witnessed a record outflow of $1.5 billion within just four days, reflecting shifting investor sentiment and fund reallocations.

- Kulr Technology Invests in Bitcoin: Kulr Technology has entered the Bitcoin market with a $21 million treasury purchase, highlighting growing corporate adoption of digital assets.

- Ethiopia’s Renewable Mining: Ethiopia is leveraging hydroelectric power to boost Bitcoin mining operations, promoting sustainable energy solutions in cryptocurrency infrastructure.

Key Insights

- aSOPR Decline: The Adjusted Spent Output Profit Ratio (aSOPR) has dropped to 1.03, indicating that more investors are realizing losses during this period.

- Exchange Inflow Trends: Exchange inflows have declined from 333K BTC to 254K BTC, suggesting reduced selling pressure and higher holding sentiment among investors.

- MVRV Ratio Movement: A decrease in the MVRV ratio from 2.43 to 2.35 underscores a potential undervaluation, possibly signaling a favorable entry point for buyers.

- Puell Ratio Decline: The drop in Puell Multiple from 1.18 to 1.00 highlights lower profitability for miners, which might influence mining dynamics and supply-side economics.

Final Thoughts

This week’s Satsurday report reveals a dynamic market with ongoing regulatory developments, institutional adoption, and shifts in miner profitability. While indicators like lower MVRV and Puell ratios point to possible undervaluation, investors should monitor trends closely for strategic decision-making. With evolving geopolitical and economic factors, Bitcoin’s role in trade and sustainable mining practices continues to expand, reflecting its resilience and growth potential.

Found value in the insights shared here? Check out our YouTube and Twitter, loaded with content meant to educate and entertain.

Follow our Telegram for a sneak peek at alpha; for an even deeper dive, join our Patreon community, where we share exclusive alpha for you to be the ‘early bird.’

Follow us today, and let’s explore Web3 together