Welcome to The Satsurday, your go-to source for the latest in Bitcoin and cryptocurrency news , regulations, and adoption. This week, we delve into key metrics influencing Bitcoin’s market, along with notable regulatory updates and adoption news.

News | Regulations | Adoption

- Ohio Senator Pushes Bitcoin Legalization: A new bill has been introduced to legalize Bitcoin and crypto payments for state taxes and fees, which could enhance the adoption of cryptocurrencies in public financial systems.

- Market Liquidations Top $500 Million: Following a sharp correction, Bitcoin liquidations have soared, indicating potential volatility and heightened sell pressure across the market.

- IMF Pressures El Salvador: The International Monetary Fund (IMF) is urging El Salvador to revise its Bitcoin regulations. This move may affect the country’s status as a pioneering nation for Bitcoin as legal tender.

- Ripple and Mercado Bitcoin Collaboration: A new partnership aims to roll out crypto-enabled payments in Brazil, signaling a step forward in cryptocurrency’s mainstream adoption in Latin America.

- Bolivian Bitcoin Transactions Surge: Following the lifting of Bolivia’s Bitcoin ban, crypto transactions have skyrocketed, underscoring the pent-up demand for digital assets in the region.

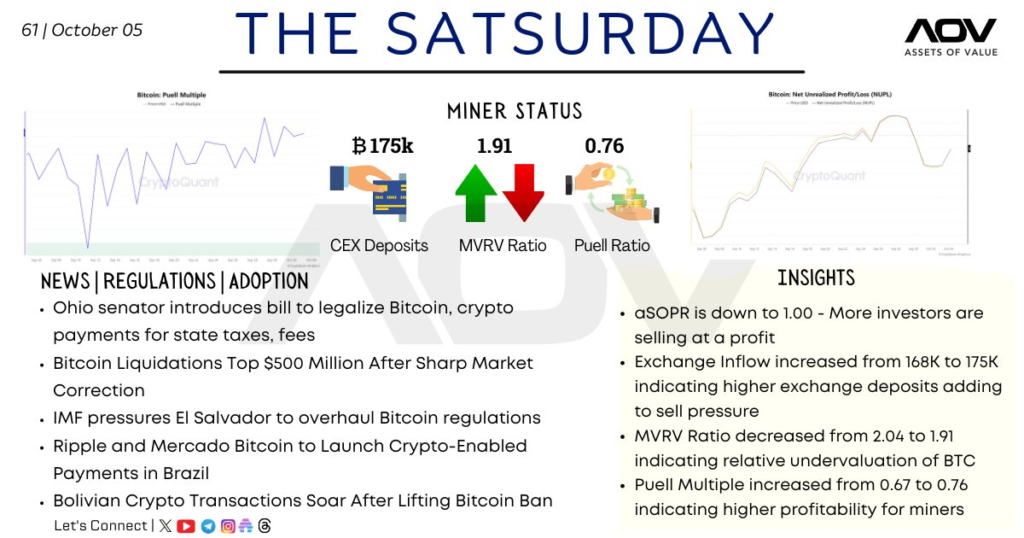

Miner Status

- CEX Deposits: Bitcoin exchange inflows have increased from 168k to 175k, reflecting rising sell pressure from market participants. This trend could be indicative of an expected bearish movement in the near future.

- MVRV Ratio: The Market Value to Realized Value (MVRV) ratio has decreased from 2.04 to 1.91. This suggests that Bitcoin is becoming relatively undervalued, creating potential opportunities for long-term holders but also indicating possible short-term market weakness.

- Puell Ratio: The Puell Multiple has increased from 0.67 to 0.76, signaling higher profitability for miners. This growth could influence miner behavior, with more miners potentially opting to sell to capitalize on the increased profitability.

Insights

- aSOPR Ratio: The Adjusted Spent Output Profit Ratio (aSOPR) is down to 1.00, indicating that more investors are selling at a profit. This is often seen as a sign of maturing sentiment in the market as traders lock in gains.

- MVRV and Puell Trends: The decline in the MVRV ratio, alongside an increase in the Puell Ratio, reflects a unique market moment. As Bitcoin becomes more undervalued, miner profitability is rising, creating a nuanced environment for both traders and institutional players.

Call to Action

For more insights on the evolving cryptocurrency market and updates on regulations affecting Bitcoin adoption, stay connected with the community on Twitter, YouTube, Instagram, and other platforms. Be sure to monitor key metrics like MVRV and Puell ratios, as they are crucial indicators of market direction and miner behavior.

Found value in the insights shared here? Check out our YouTube and Twitter, loaded with content meant to educate and entertain.

Follow our Telegram for a sneak peek at alpha; for an even deeper dive, join our Patreon community, where we share exclusive alpha for you to be the ‘early bird.’

Follow us today, and let’s explore Web3 together!