January 27 , 2024

Table of Contents

Welcome to the latest edition of The Satsurday Weekly, your source for Bitcoin market movements, technology advances, and sentiment. Let’s dive into the significant events and numbers that have characterized the past week.

Introduction

This week’s edition of ‘The Satsurday’ provides a comprehensive overview of the Bitcoin market, giving investors and enthusiasts insights into the latest trends and statistics that are shaping the cryptocurrency landscape.

Market Metrics: A Closer Look

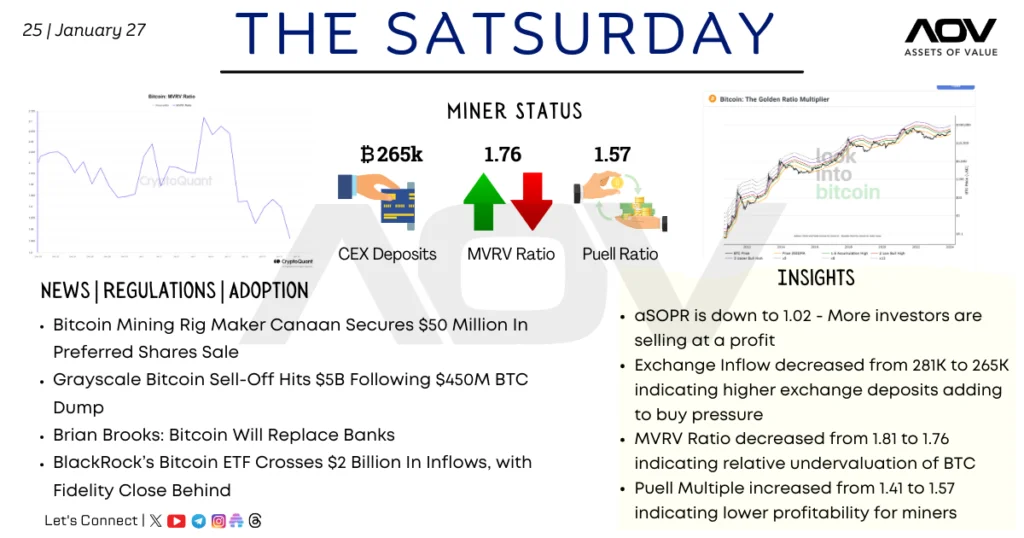

- Bitcoin MVRV Ratio: The Market Value to Realised Value (MVRV) Ratio has dropped from 1.81 to 1.76, suggesting Bitcoin may be undervalued.

- Puell Ratio: The Puell Ratio has increased from 1.41 to 1.57, which could signal lower profitability for miners. The daily Bitcoin issuance value (in USD) divided by the 365-day moving average is this ratio. An increase usually means newly produced Bitcoins are worth more than the yearly average, which could affect miner revenue and the market.

Insights and Analysis

- aSOPR Downtrend: The Adjusted Spent Output Profit Ratio (aSOPR) has declined to 1.02, indicating more investors are profiting from Bitcoin sales. The aSOPR measures the profit ratio of coins traded on-chain, hence a number larger than 1 indicates a profit.

- Exchange Inflow Shift: There has been a noticeable decrease in exchange inflow, down from 281K to 265K. Fewer Bitcoins are being placed into exchanges, which may indicate a decrease in selling pressure and bullish attitude among holders.

Noteworthy News

- Canaan’s Capital Boost: Bitcoin mining gear company Canaan secured $50 million in preferred shares, signalling infrastructure investment as the market grows.

- Grayscale’s Sell-Off: Grayscale, a renowned digital asset management, lost $5B after a $450M BTC dump.. This move reflects the volatility and rapid changes in investor sentiment within the Bitcoin ecosystem.

- ETF Milestones: BlackRock’s Bitcoin ETF has surpassed $2 billion in inflows, with Fidelity not far behind. The success of these ETFs underscores the increasing institutional interest in Bitcoin as an investable asset class.

Opinions

- Bitcoin as a Bank Replacement? Brian Brooks has sparked conversation by suggesting that Bitcoin will replace banks. This viewpoint aligns with the narrative of Bitcoin as not just a store of value but also as a potential disruptor to traditional financial systems.

Conclusion

This week’s ‘The Satsurday’ shows Bitcoin market data that indicate caution and confidence. While some indicators suggest that now might be a good time to buy. The overall market sentiment remains cautious due to miner profitability concerns and the recent sell-off activities. As always, investors are encouraged to perform their due diligence and keep abreast of the rapidly changing landscape of cryptocurrency.

See you all in the next edition of The Satsurday

Found value in the insights shared here? Check out our YouTube and Twitter, loaded with content meant to educate and entertain.

Follow our Telegram for a sneak peek at alpha; for an even deeper dive, join our Patreon community, where we share exclusive alpha for you to be the ‘early bird.’

Follow us today, and let’s explore Web3 together!